The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

I had an interesting realization surface the other day:

My entire strategy thus far on my journey to true financial independence (where my investments create enough passive income to live on, and work becomes optional) was to work high-paying gigs (regardless of passion or enjoyment) and hit the magic number ($1M alone or $2M with a spouse – allowing for a $40,000 or $80,000 drawdown respectively, tax-free and every dollar available for spending) in as little time as possible.

Because of my save rate and projected increase in income, I was on track to hit $1M in less than 7 years – that lands me right at age 33.

“7 years? F*** yeah! I can do that.”

Fast-forward 6 months of grinding 80 hours per week, working Saturdays, waking up at 5, and constantly feeling behind.

Guess what? 7 years doesn’t feel like it’s going to fly by anymore.

Could I muscle through it? Sure. Will I muscle through it? Maybe.

But a big part of striving for financial independence is living an intentional life – clarifying what it is, exactly, you want – and in my discovery phase, I asked myself: Do I want a million dollars? Or do I want control over my time?

Unequivocally, it’s not about the money. The money is just what you use to buy the time.

Where I am now: 25% of the way toward FI

As I write this in 2020, my net worth is hovering somewhere around $260,000, which means I’m a little more than 25% of the way there.

Nobody talks about the weird in-between phase of cranking toward FI. It’s this weird high in the beginning – you feel like you’ve discovered the secret to life, and the adrenaline high is powerful enough to make you swear off your nail appointments and non-happy hour-priced cocktails forever.

But then there’s this period that comes later – after your first few, big milestones – where suddenly, you look out at the horizon, and you realize – shit, that’s still really far away. Sure, it’s happening! Sure, the more you invest, the faster it grows! But damn, there’s nothing like working your ass off, investing like a crazy person, and looking up and going, “OK… only 7 more years!”

The point is, it’s a marathon, not a sprint – so my, “It’s cool, I don’t need time, sleep, a social life, or balance – I’ll work four jobs until I’m 33 and then chill,” plan started to look (and feel) like it was losing the plot.

FI is about optimizing for happiness

…and for me, a big source of the happiness that I feel day to day comes in those quiet moments – the rare afternoons where meetings get canceled. Saturday mornings where I can take Georgia to the park and not immediately rush home or risk being late for something. Friday nights when I can rest on the couch, watch a little TV, and ignore email, knowing I’m (mostly) free for the next 48 hours.

The more I started to notice my joy in the simple moments, the more I wondered if maybe there were a less extreme way to achieve what I’m trying to do.

Simply working fewer corporate jobs and making less money didn’t feel like a great answer, since it would still require me to be tethered to a work station from the hours of 9 to 5 every day, 5 days a week. Whether I’m responsible to one employer or three might make the days themselves a little less chaotic, but it didn’t quite solve for the “technically required to be sitting at a desk all day” thing. There may be less work, but my time wouldn’t be mine.

And sadly, I feel too much loyalty, obligation, and corporate guilt to half-ass my work – if my name is attached to something or I’m a member of a team, I take my responsibility to people too seriously for the answer to be, “Care (and try) less.”

The birth of the “mini retirement” concept

There was one moment specifically where I remember feeling a little silly. I was talking to a friend who owns her own small business, works her own hours, and genuinely enjoys her day to day life. If I had to guess, I bet she makes anywhere from $3,500 to $5,000 per month, depending on her client load.

“So… why are you working so much? What are you trying to do?” She asked me. “Katie, what are you saving for?”

I launched into my monolithic explanation about financial independence. Early retirement! Endless vacation! No responsibilities! Control over your time! Mission-driven work! Purpose!

She seemed confused.

Frustrated, I changed my approach: “I just want to be able to do whatever I want all the time,” I said, probably expressing my obsession with FI in the simplest terms I had found yet.

It wasn’t about financial independence. It was about independence. I was sure she would get it.

“Hm,” she replied, “Well, I guess that makes sense… but I already do that.”

A thousand records scratched. Cars crashed. Air horns sounded.

“I already do that.”

She was right. She did. She slept until 8. Took yoga classes in the morning. Had a few clients in the afternoons. Enjoyed her evenings.

Split-screen that leisurely, balanced life with my (chosen) day-to-day:

Crawl out of bed at 5:30. Take the dog out. Post on Money with Katie and work through DMs until 6:30. Make a playlist. Teach a fitness class from around 7:30 to 8:30. Rush home, shower, and throw on clothes in roughly 20 minutes for meetings from 9 to noon. Take the dog out, eat some food, and answer emails over lunch. Dive back into meetings from 1 to 5, then finish up any unfinished tasks until around 7.

There’s hardly any time for serendipity, true creative bandwidth, or – frankly – relaxation and enjoyment.

(I know – boohoo, bitch, let’s throw it back to the industrial revolution where people wasted away in factories for 30 cents a day, waist-high in meat scraps. You don’t “relax and enjoy” your day? You don’t “have creative bandwidth”? Cry about it and shut the f*** up!)

I get it. But hey, it’s 2020. We can have craft sushi delivered to our door in 20 minutes and people are physically adhering longer eyelashes to their faces. We’ve evolved, and so have my expectations.

The truth is, I was so jealous of this friend’s lifestyle but so unwilling to admit it to myself because it meant my 7-year path would feel even longer and harder by comparison. I felt better by imagining her lifestyle as my eventual reward for my hustle, but still, her voice rang in my head:

If I could just… have that now, would I?

Is there another way?

So what’s a mini retirement (or, “baby FI”)?

Well, a mini retirement basically leverages the same 4% rule that drives traditional FI – but in a slightly different way.

While calculating real, true, adult, triple-XXX financial independence helps you figure out how much of your total income you’d need to invest over time to retire completely, “baby FI” – a term I’m coining right here, right now – is predicated on the idea that you will still have some income – just not the multiple-six-figure, four-job chaos you were roped into before.

In truth, it’s really just shortening the timeline on small business dreams – still with lower risk, but not totally risk-free.

When you’re totally FI, your projects don’t have to produce any money – your assets do that for you. Your work is utterly optional.

But with baby FI, your investments only have to produce some smaller, predetermined amount of your expenses (or, realistically, maybe none of them – maybe your business or pet project does that – but the investments still grow in the background).

For example, my monthly expenses right now are approximately $2,500 for me alone. At true FI, that’s a FI number of $750,000 (which is, obviously, lower than my actual goal of $1M, which is bigger to build in some buffer – and because we might as well go for seven-figure gold, right?).

If I were approaching this with a “baby FI” mindset, I’d say, “All right – my business needs to produce somewhere between $1,250 and $2,500 per month, and my investments may need to provide up to $1,250 per month at the most.” Extrapolated over a year, that would mean the “annual expense” number my investments need to provide for is $15,000, and the FI number is $375,000 – $375,000 would spin off $15,000 of returns per year safely, give or take, thereby producing at least half of what I’d need to cover my expenses.

Considerations for baby FI – what’s the worst that could happen?

In this thought experiment, we’re talking about leaving traditional work when investments reach $375,000 – enough to spin off returns that can cover roughly half your monthly expenses (obviously, if your spending situation is different, this equation nets a different result – it highlights well why keeping your spending low is so crucial to providing you with options, and I’m going to take this opportunity to shamelessly plug the Budget Like a Millionaire Masterclass), instead of plowing through to invest the full $1M and walk away from earning completely, cold turkey.

This means you need to somehow produce at least enough to cover half your monthly expenses (or, preferably, all of it) with a business or project of choice, but you (probably) won’t have anything left over to add to your investments.

This begs the question: What’s the worst thing that could happen?

Well, the obvious potential risk is that your project or earning avenue of choice won’t produce half (or all) of your expenses. But let’s set that aside for a moment, because there’s a massive potential upside, too: After all, most FI people end up making more in early retirement because they finally have the freedom to pursue their passions as adults without risk or full-time employment. Since it is my sincere belief that most financially independent people have a decent shot at out-earning their prior corporate selves, we’ll take the intermediate approach:

Let’s pretend you do make enough to cover roughly 75% of your monthly expenses. This means your investments provide for the other 25%, assuming you aren’t able to cut back on spending or scale your income in any way.

25% of $30,000 per year is $7,500. Your investments would have to provide you with $7,500 per year. Since $7,500 is only 2% of $375,000, you’re well under your safe withdrawal rate of 4%, and your investment will continue to grow despite you not adding anything to it.

But by how much?

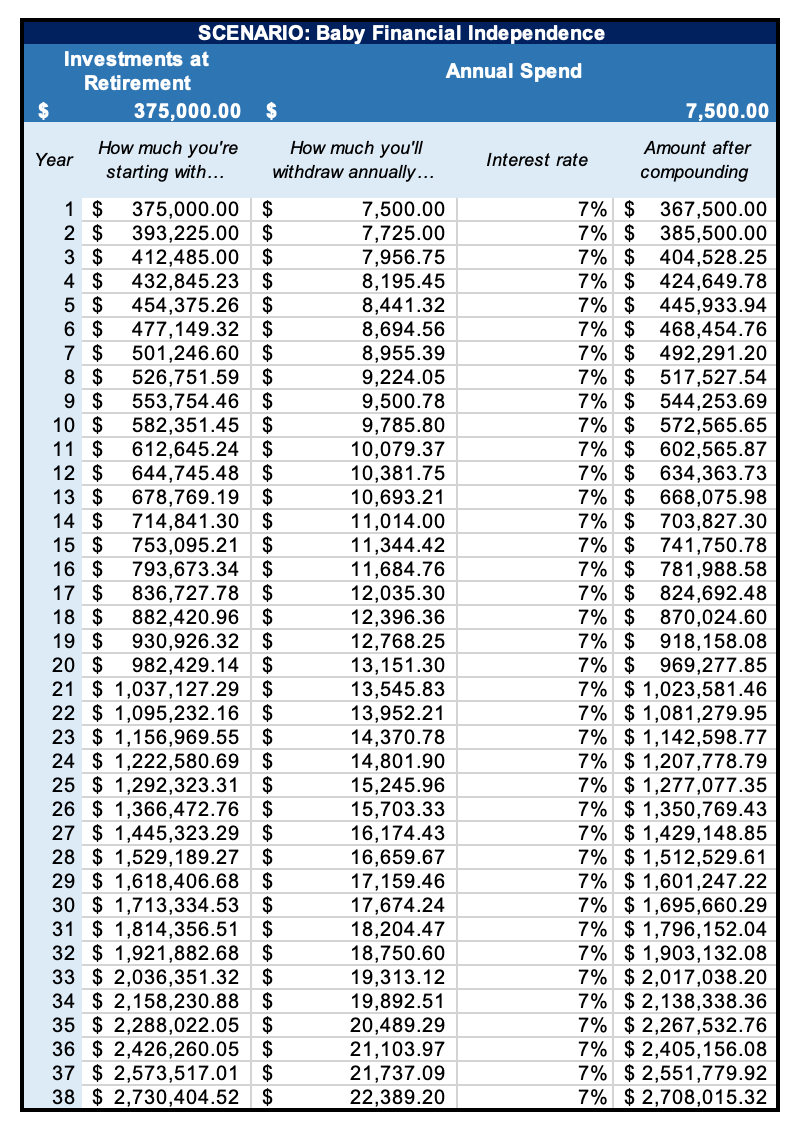

Assuming your withdrawal increases by 3% per year because of inflation and your average return is 7%, your drawdown looks like this:

This is an amended version of the Financial Independence tracker that lives in the Wealth Planner.

As you can see, 38 years from now, you won’t be withdrawing $7,500 – you’ll be withdrawing $22,389, because that’s $7,500 adjusted for 38 years of inflation.

But hey, that’s all right – because your baby FI portfolio grew to $2.7M on its own without you adding another dollar and continuing to withdraw 25% of your monthly expenses, assuming your business or project (or a subsequent one) was never able to produce more than 75% of your monthly expenses.

To me, this is a rather compelling worst case scenario

Because sure, $2.7M in 38 years from now isn’t the same thing as having $2.7M today (our $7,500 > $22,389 is the perfect example of that), but there are plenty of people who work dead-end jobs they don’t enjoy for their entire adult lives who are on track to retire with less than $2.7M.

The fact that you could walk away from “real” work as soon as you hit $375,000 and make a go of your own business and still end up with more than most Americans when you’re of traditional retirement age even if your business never takes off and it only ever makes enough to cover 75% of your monthly expenses (that’s $1,875, in this example) using the example we did today of a $2,500/mo. lifestyle (in 2021 dollars), I’d say that risk level is pretty damn low.

$1,875 is less than $500 per week.

Why does this work? How does this work?

Well, it works for a few reasons:

-

Most people live most of their lives in a state of perpetual drift. They make more money over time, so they spend more money over time. Rarely do we take a step back and ask what our monthly expenses could be if it meant we got to spend our lives doing the work that mattered to us.

-

Usually when we look at our incomes, we want to have enough to be able to save and invest some after we’re done spending. In this example, our income only needs to cover our basic expenses – because the ‘saving and investing’ hard part is already done. That’s why a job that makes less than $2,000/mo. (in this example) is adequate.

-

Compound interest is insanely powerful. It’s the magic that powers financial independence principles, and this example is no different. After all, if our $375,000 were in savings, this would be a different story. You’d run out of money a couple decades in, instead of ending up with nearly $3M despite not adding another penny.

What’s the catch?

At first, I thought the catch would be that $2.7M wouldn’t be enough in “real” retirement once you started to actually draw down the full 4% – and keep in mind, $2.7M in 38 years is roughly the same thing as having $870,000 today, so it’s not the same.

But when I crunched the numbers and did a drawdown where you started today with $1,000,000 and withdrew a full $40,000 per year for 38 years, you ended up with $2.2M. Now, detail-oriented readers will notice that I increased the withdrawal to a full 4% for the $1M example – but that’s because that’s the intent of waiting to leave until you have the full million. You grant yourself the reward of a full 4%, tax-free withdrawal.

Still, the point stands – leaving traditional work with $375,000 and working in some capacity you enjoy to produce at least 75% of your monthly expenses, or $1,875 per month (if your monthly expenses are at or around $2,500/mo.), actually leaves you with more after 38 years than waiting until you hit the full million and completely throwing in the towel on earning – not less.

Conclusion: Baby FI may have some merit

If you’re planning to pursue a business idea or passion project that has strong proof of concept (that is, you’ve already seen it can make money) anyway, it may not make sense to plow through to hit your full FI goal. To figure out what your FI goal is based on your current salary, save rate, and spending habits, you can use the Financial Independence Tool for an easy plug-and-play situation or simply follow the same methodology outlined in this post.

Just keep in mind the tool will tell you your FULL financial independence number, not the baby FI middle-ground we discussed today.

Update from 3 years later

Hello! Late 2022/early 2023 Katie here to check in. It turns out my plan (to take my side project full-time after reaching a particular net worth) worked out the way I hoped it would. Call it survivorship bias, but it makes quite a bit more than my old corporate gig did.

It’s gratifying to see my “mini retirement” thought experiment yield real-life results.

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time