Why the Marriott Bonvoy Boundless Card is My Top Hotel Card

July 14, 2020

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

My Boundless card that I acquired in 2019 during the 100,000-point bonus period.

Before we dive in…

Let me hit two high points for why this card is a good choice right now during the COVID travel pause:

-

6x points on groceries through July 31 (which I balance with my Southwest Rapid Rewards Priority Card, which earns 3x points that count toward Companion Pass)

-

Announced today: 10x total points on restaurants (including DoorDash) and gas stations through September 15, making it a more alluring choice than my usual restaurant card (Sapphire Preferred) or usual gas choice (Discover It cash-back)

Overall considerations

After I acquired arguably two of the best travel cards of all time (the Chase Sapphire Preferred and American Express Platinum), I was ready to expand my repertoire into the hotels space. Having experienced fantastic, high-value vacations at Hyatt properties, I was tempted to pursue a Hyatt card – but opted for the Bonvoy Boundless first for a few distinct reasons.

Breadth of properties, both in location and the hard-to-quantify “fanciness factor”

You can find a Bonvoy property just about anywhere. I was confident that, regardless of where I was traveling, I’d be able to find a Marriott. The Bonvoy program was created in 2019 and combined the Marriott portfolio, the Ritz-Carlton collection of properties, and the now-defunct Starwood Preferred Guest (SPG) program. Whether I was down to play small in a PointSavers Category 1 property for 4,000 off peak points per night or ball out with an 85,000-point nightly redemption rate, I knew that – regardless the trip type – my Bonvoy points would prove versatile.

Bonvoy has some 30-odd different brand names in its portfolio, from the W to the Residence Inn.

Compare that to, say, IHG Rewards, in which the portfolio of properties is smaller and skews more toward Holiday Inns, Holiday Inn Expresses, and, at the fancier end, Kimptons and Hotel Indigos. While those properties are probably more in my actual budget, my points budget is more aspirational. Katie Gatti without a Bonvoy card would never stay at the St. Regis. Katie Gatti equipped with a sign-up bonus just might. And that’s the whole point, right?

As I noted before, Hyatt and Hilton were contenders for my first hotel card, but their portfolios are quite a bit smaller than Bonvoy’s – fewer than 15 each.

Now’s a good time to note that it doesn’t hurt to play the field and get a few different hotel cards. But if you’re going to get one, I’d hang my hat on this one.

Existing status from the AmEx Platinum

While the Bonvoy Boundless card comes with Bonvoy Silver Elite status, the AmEx Platinum carried Bonvoy Gold as a perk (a level above). Bonvoy Gold Elite has a few key benefits, including:

-

25% earning bonus on stays booked with Bonvoy

-

Enhanced room upgrades on arrival, when available

-

Late checkout

…and more. I figured if I had Gold status with a specific hotelier already, it made sense to double down on the loyalty and begin banking points specific to the program in which I already had a decent status. (I.e., if you can book a 20,000/night, off peak Category 4 room and then get upgraded upon arrival, those points go further.)

Redemption structure

If you’d like to get a sense of how many points it’ll take to redeem a single night at a Bonvoy property, you can check out the redemption chart here. Earlier this year, Bonvoy announced (to my dismay and the dismay of many other Bonvoy loyalists) changes to the redemption values in which a not-insignificant number of hotels moved up a category (e.g., a Category 4 became a Category 5 and therefore costs more), while only a few moved down.

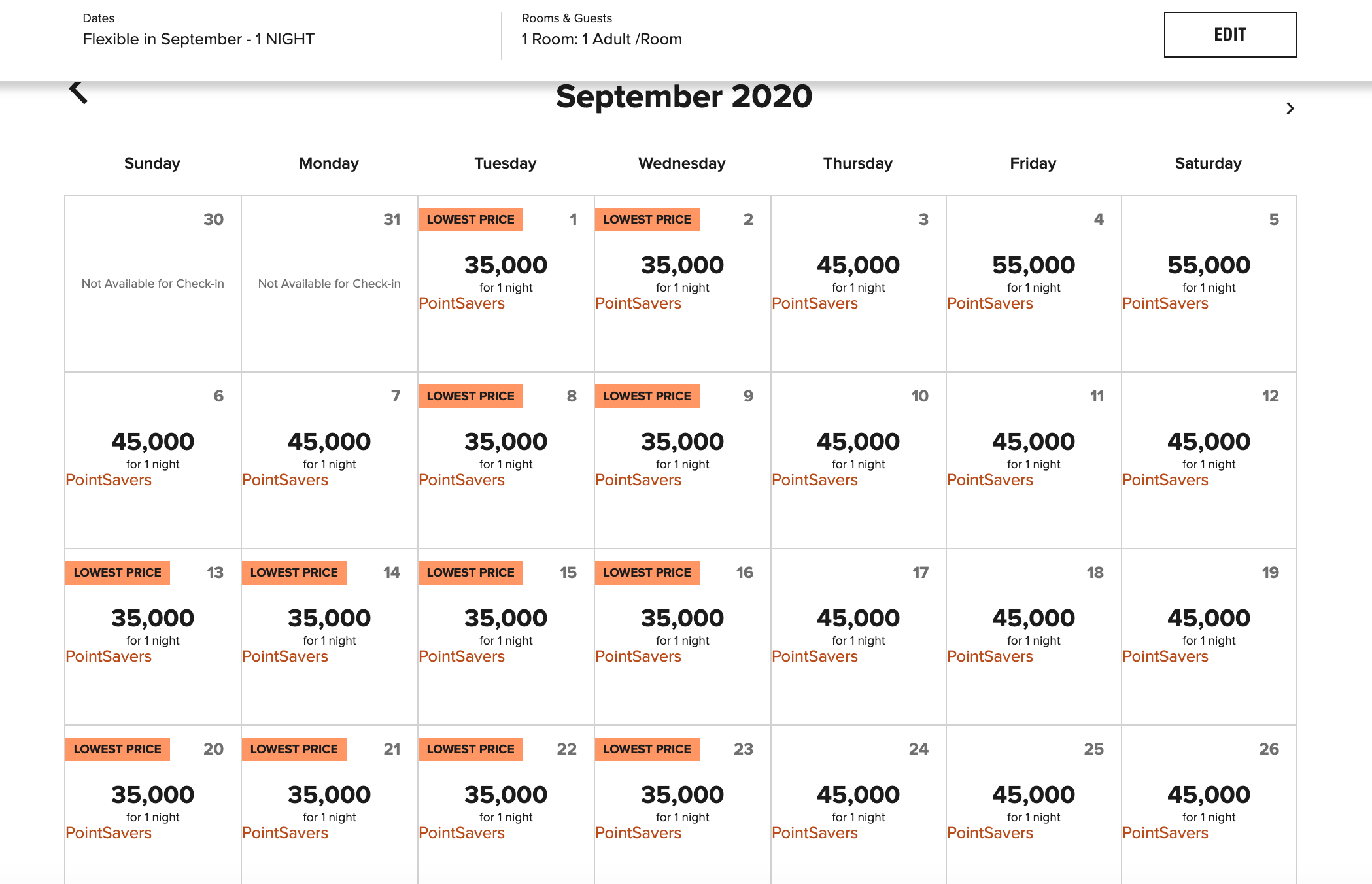

Regardless, take note of the following: Off Peak, Standard, and Peak pricing. A Category 6 property (like the Renaissance Aruba Resort and Casino) is 40,000 points/night in off peak seasons and 60,000 points/night in peak seasons. That’s a pretty significant difference. I like to use their flexible booking calendar to isolate, at a glance, the off peak times to visit nicer properties.

Fun fact… the Renaissance Aruba Resort linked above was considered a Category 5 hotel when we booked it in March for our ill-fated Aruba trip and was bumped up to Category 6 after we canceled and rescheduled it.

Luckily, demand is so low that it ended up costing less anyway because there were nights designated as “PointSavers” opportunities – making an off peak night 35,000 points. This was cheaper as a Category 6, off peak “PointSavers” (35,000 points) than as a Category 5 Peak redemption (40,000 points). (Are you following? Does your head hurt?)

Here’s a screen-grab of the Flexible Dates calendar for the Renaissance in September. All you need to know is that the orange flag and “PointSavers” label are your friends.

The strength of the card offering and sign-up bonuses

Once I had more or less decided on Bonvoy, it was time to pick a card. The current portfolio has three offerings:

-

Bonvoy Bold with no annual fee but pretty minimal other benefits and a lower earning bonus (in my opinion, a little useless)

-

Bonvoy Boundless (my choice) with a $95 annual fee, 100,000 points (at the time), and an annual free night award (worth up to 35,000 points)

-

Bonvoy Brilliant, which carried a $450 annual fee (and is issued by American Express, unlike the other two cards in the portfolio that are issued by Chase Visa) – this offered $300 in Bonvoy statement credits and a few other bells and whistles, but not enough, I decided, to justify the fee

In short, the Boundless struck the perfect balance. A low annual fee, a high sign-up bonus, and an annual free night award that would more than compensate for the annual fee. I’ve seen 35,000/night properties that cost $500 in cash, making your free night certificate worth 5x the annual cost of the card.

Other considerations

If you’re entering the cobranded hotel cards draft, another thing to think about is how the hotel card will pair with your existing portfolio.

Bonvoy was a slam-dunk for me because both my Ultimate Rewards (Chase Sapphire) and Membership Rewards (AmEx Platinum) points could be transferred to Bonvoy 1:1, meaning if I was a little short on Bonvoy points, I could top myself off using another reservoir.

This isn’t necessarily a best practice; generally speaking, hotel points are valued lower than these versatile Chase and AmEx points – but in a scenario where you’re trying to book two nights at a 60,000-point property and you’ve got 110,000 Bonvoy points to use, it’s nice to have the option to transfer 10,000 more if you want to pay entirely in points.

Bonvoy also enables you to combine cash and points, meaning you could pay for the difference in cash. This is a more in-depth value calculation that depends on the property and your options.

It’s also worth noting here that occasionally there will be bonus transfer opportunities between AmEx and its partners where you can transfer a Membership Rewards point on a 1:2 basis (or more), so 1 AmEx point would become 2 Bonvoy points. I wouldn’t suggest doing this unless you’ve got a trip/property in mind since the AmEx points are typically more valuable.

Watch-outs

As always, Bonvoy points are just another currency to add to your arsenal of free travel tools. If you find a property you love on the Bonvoy site, be sure to check how much it costs in your other travel portals too (Sapphire, AmEx, etc.).

Last summer, we visited the US Grant in San Diego, a Category 6 hotel that typically runs 40,000-60,000 Bonvoy points per night. In the Membership Rewards portal, this hotel was a member of Fine Hotels & Resorts and only cost 25,000 points per night, so we booked two nights for 50,000 points instead of booking through Bonvoy. As a result, we received:

-

All the trappings of a FH&R stay, including the free daily breakfast credits and $100 resort credit

-

Early check-in and late checkout

-

A suite upgrade

-

Bonvoy points for the stay

That’s right – we booked using AmEx points and still received Bonvoy points for the purchase. I’m not even sure if that’s normally how that works, but I believe it happens because American Express pays the vendor (Marriott) for the purchase and then reimburses you when it deducts the points from your Membership Rewards account. As a result, if your Bonvoy number is tied to the reservation, you’re credited with the Bonvoy earn. And, if you’re Gold Elite, that earn is worth 25% more. A thing of beauty.

Applying

If you’d like a full rundown on which cards to get when, you can check out the Travel Rewards section of this site. If you’re ready to apply for Bonvoy, I’d suggest using this link because the sign-up bonus sometimes drops down from 100,000 to 75,000 — but the referral link still triggers three free night awards worth 35,000 points each, for a total value of 105,000 points.

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time