How to Choose the Right Airline Loyalty Program for You

August 2020

Disclaimer: Because of the screenshots of different airlines’ sites in this post, it’s probably best to read this on a desktop computer rather than a phone.

Oh, man. This isn’t a question that I get too often (probably because the Southwest Heart is tattooed across my forehead), but I think that may be because most of us don’t really question who we fly. Growing up two miles from CVG, I always flew Delta because they had a chokehold on the Cincinnati market.

In Dallas, most people fly Southwest or American (and they’re not shy to tell you why they picked their Dallas airline of choice).

So what’s your favorite airline, and why is it Southwest?

I kid.

But some of us really do have options about which airline to hitch our checked luggage, and this post is intended to help you understand how, exactly, to evaluate an airline’s loyalty program. Which airline is worthy of your loyalty? Let’s begin.

Why you should care

Airline loyalty programs and their related credit card offerings can make or break a travel budget — as long as you know how to take advantage of the best ones.

When assessing the value of an airline’s loyalty offering, there are two approaches worth exploring: the obvious cash value of a single point, and the harder-to-define elements (upgrades, breadth of service, etc.).

A traveler looking for a holistic perspective of value should look at a slew of difficult-to-quantify factors (in addition to the more obvious numbers) that can make the difference between long-term loyalty and a flash in the points pan.

My favorite thing: Earning potential

winks.

First, it’s important to dig into the obvious: how easy is it to earn points on the fare class you’re most likely to purchase?

If you typically purchase the least expensive ticket (think Basic Economy), it’s unlikely you’ll be able to amass a sizable number of points from travel alone. However, if you’re riding high on an expense account or often buying First Class seats, the earn rate might be a larger factor.

Some airlines reward customers for choosing the higher fare by increasing the points or miles multiplier. To assess any given airline, this is a pretty basic trial-and-error test.

The math homework below rivals that of a 6th grade entrance exam, but it’s worth it to determine the best option.

Choosing a weekend at random (e.g., July 10-12, 2020) and a route that’s profitable and popular for both airlines to make it as comparable as possible, the first step is to look at two different airlines’ price and points/miles breakdowns.

Consider a roundtrip, Main Cabin ticket on Delta for DFW-ATL at $496.20. This purchase earns 2,380 miles, making the cost per mile approximately 21 cents.

The cost of a First Class ticket for the same route on the same day is $729.20, earning 3,545 miles – this works out to (again) about 21 cents per mile.

This is crucial information because it means Delta’s fare classes are treated equally from an earning perspective.

Now consider the same route on Southwest: the Wanna Get Away fares (similar to Main Cabin) on the same day for a nonstop DAL-ATL route work out to about $303 roundtrip, earning 1,698 points (meaning that, roughly, each point costs 18 cents).

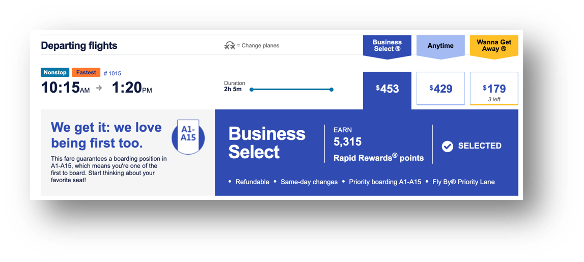

That same trip in the most expensive fare class, Business Select, costs a whopping (and hardly justifiable) $906, but earns 10,630 points – making each point cost only 9 cents.

And remember, we’re talking about the cost of a point, not the value. The value is how much you get in exchange for that point when you go to redeem it. The cost is how much you have to spend in order to get it in the first place.

You’re doing great. Let’s keep going.

It’s worth it to figure out (on average) about how much you’d have to spend to earn points and if there are any Costco-style, buy-in-bulk benefits that come with more expensive fare classes. The formula to determine how much a point or mile costs is:

[the cost of the ticket in cash] ÷ [the number of points or miles earned] = [the cost of a single point or mile]

TL; DR: It’s hard to get points- or miles-rich by buying the types of fares most people choose. The more likely drivers for the average frequent flier will be credit card acquisition bonuses, referral bonuses, and ongoing spend in bonus categories, so that’s worth considering at the outset when entering the airline loyalty program draft.

Redemption values

The natural question that follows for most is: Great, so I’ve got my 2,000 points – what can I do with them? Ultimately, this is probably the most consequential thing to consider. A 60,000-point sign-up bonus doesn’t mean much if one domestic roundtrip flight costs 58,000 points.

Generally, the most helpful way to determine the standard ticket cost one can expect from a carrier (in miles or points) is by looking at the “average structure fare” (in other words, not a close-in ticket value that’s probably driven up by current demand) found in searches about 90 days out.

Do miles go on sale when fares go on sale? E.g., does a roundtrip from Charlotte to Phoenix always cost 22,000 miles, regardless of whether the cash value of the fare is a $300 competitive match or a $900 close-in fare?

By toggling between a fare within seven days from now and another for the same route that’s three or more months away, it should be clear if the airline’s points/miles redemption values vary based on the cash value of a ticket. Here’s an American Airlines CLT-PHX route that reflects the example mentioned above, for reference:

A close-in Basic Economy fare for this route is $901.

The “structured fare” is probably between $347 and $372.

90 days out, a $372 fare = 22,000 points to redeem.

The $901 fare costs 61,000 points to redeem.

That effectively tells us that American’s point values for their routes are not static – they change as the price changes. The same isn’t true for Hyatt, for example, where the price of a room could fluctuate between $250 and $600 but still cost 25,000 points per night regardless.

Putting it together

Extending the earlier Dallas to Atlanta comparison using Delta and Southwest, pretend someone had shelled out for the more expensive fare on Southwest to earn 10,000+ points – what can those do? In this example, the return leg of the trip would have cost 8,883 points (had someone chosen to pay for it in points), meaning the points earned from the first trip would’ve been enough to cover more than half of the second trip.

In essence, someone could spend $906 on a Business Select roundtrip to earn a little more than a Wanna Get Away one-way for next time.

The formula for determining the value of a point during the redemption half of the process is:

[the cost of the ticket in cash] ÷ [the cost of the ticket in points or miles] = [the value of each point or mile]

In this redemption example, the Southwest point is valued at a little more than 1¢.

The Main Cabin return leg for the Delta scenario is 15,500 miles one-way – meaning someone would have to fly roundtrip between Dallas and Atlanta in First Class on Delta (for $729 a pop) five times to earn enough miles to book that Main Cabin one-way.

So what does this mean? On Delta, a flier interested in this route would have to spend around $3,646 to earn their first one-way.

And yet, the value of each mile is about 1¢, just like Southwest.

Listen, I don’t make the rules. I just bend them.

The headline here is that you could spend $906 on Southwest and earn half a trip. You’d have to spend more than 4x that on Delta to earn the same thing.

TL; DR: Rather than just looking at the value of each individual point or mile when redeeming, it’s wise to consider the entire picture – the lower the bar to redeem, the easier it is to fly using hard-earned points or miles.

More realistic earning opportunities

That brings other earning ability to the forefront – what does the airline’s credit card breakdown look like in terms of sign-up bonuses? Are they offering any additional earning incentives in light of COVID? Most airlines have in-flight offers that are higher than their average offering; as a general rule, it’s probably worth waiting until the card hits at least 60,000 in its sign-up bonus.

In a lot of cases, it’s great to get the airline card for the sign-up bonus, but often other cards (Sapphire Reserve with 3x points, AmEx Platinum with 5x, etc.) offer better incentives for flights than the airline cards themselves – and those cards offer transferability to pretty much any airline you could conceive of flying.

In conclusion: once you land on the airline of their dreams, the best bet is to pair the airline’s credit card with a travel card that’s not tied to any particular loyalty program.

Other considerations if you like flying how, when, and where you want

What additional tangible value can be squeezed from the loyalty program? Free upgrades, Companion Passes, free bags? Southwest and Alaska offer the ability to earn “Companion” passes or certificates, both of which give another person (a) almost free or (b) deeply discounted travel when they fly with the primary traveler.

It’s worth noting that Southwest allows the Companion to fly free, unlimited, for an entire year, paying just $5.60 in taxes and fees each way, making it a slam dunk for savvy couples. The Alaska Companion Certificate is a once-annual benefit.

Of course, the Southwest Companion Pass is more difficult to come by, while the once-annual Alaska benefit is a perk of their credit card – still working through the details of my “How to Earn Companion Pass” article, so bear with me.

It’s also hard to overstate the importance of breadth of service from your home airport: an airline with an incredibly lucrative loyalty program probably won’t mean much if they only offer connecting service from your city (especially if there’s another carrier that has a substantially better network).

Certain hubs probably fall under this category: Charlotte fliers will probably choose American Airlines, Portland fliers probably prefer Alaska, etc.

Last, it’s always worth making a nod to reward seat availability – while it’s hard to assign a specific value to this, airlines that apply heavy blackout dates or rewards seat caps are inherently less valuable than those that enable booking whenever, wherever.

An assessment of an airline loyalty program’s value should almost definitely consider what types of restrictions are put on reward seats – if popular flights have low limits on how many seats can be booked in miles or points, it might be frustrating to attempt flying on popular weekends or routes.

So who’s the best?

I mean, you already know what I’m going to say:

Southwest Airlines clearly has the best loyalty program if you care about the ability to earn points that you can actually use for * gasp * redeeming flights. And if you had Companion Pass into the mix, it’s a no-brainer.

The only people I know who fly other airlines and actually enjoy it are people whose parents are Million-Miler Platinum Member Fancy Shmancy Expense Account Daddies who can use their bank of 10,000,000 points to book them free First Class seats. (To be clear, I’m not putting down the Million Milers – I hope to be an Expense Account Daddy for my children someday, too.)

My point is, regular people starting from scratch with no airline affiliation are going to get the most for their money from Southwest, hands-down. And lucky for you, the Southwest Rapid Rewards Credit Card is poised at a sweet 65,000-point bonus right now. Curious which card in the arsenal I chose for myself? Here’s a breakdown. If you’re interested, you can apply here and hit the ground running.

Let me know who you choose once you enter the draft. See you next time!