Going Through the Backdoor (Roth IRA) in 2025

May 22, 2023

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Join 200,000 other people interested in money, power, culture, and class.

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

Welcome to the world of Tiny Violin Problems, my friend.

If you make too much money to contribute to a Roth IRA per the IRS, you’ve officially entered the realm of TVPs, amongst the opulent ranks of, “There’s no more room for overhead luggage in First Class so I have to gate-check my bag,” and, “I’m not sure which down parka to bring to Aspen this winter.”

There are certainly worse problems in the personal finance world, and luckily for you, this one can be circumvented with a little extra legwork.

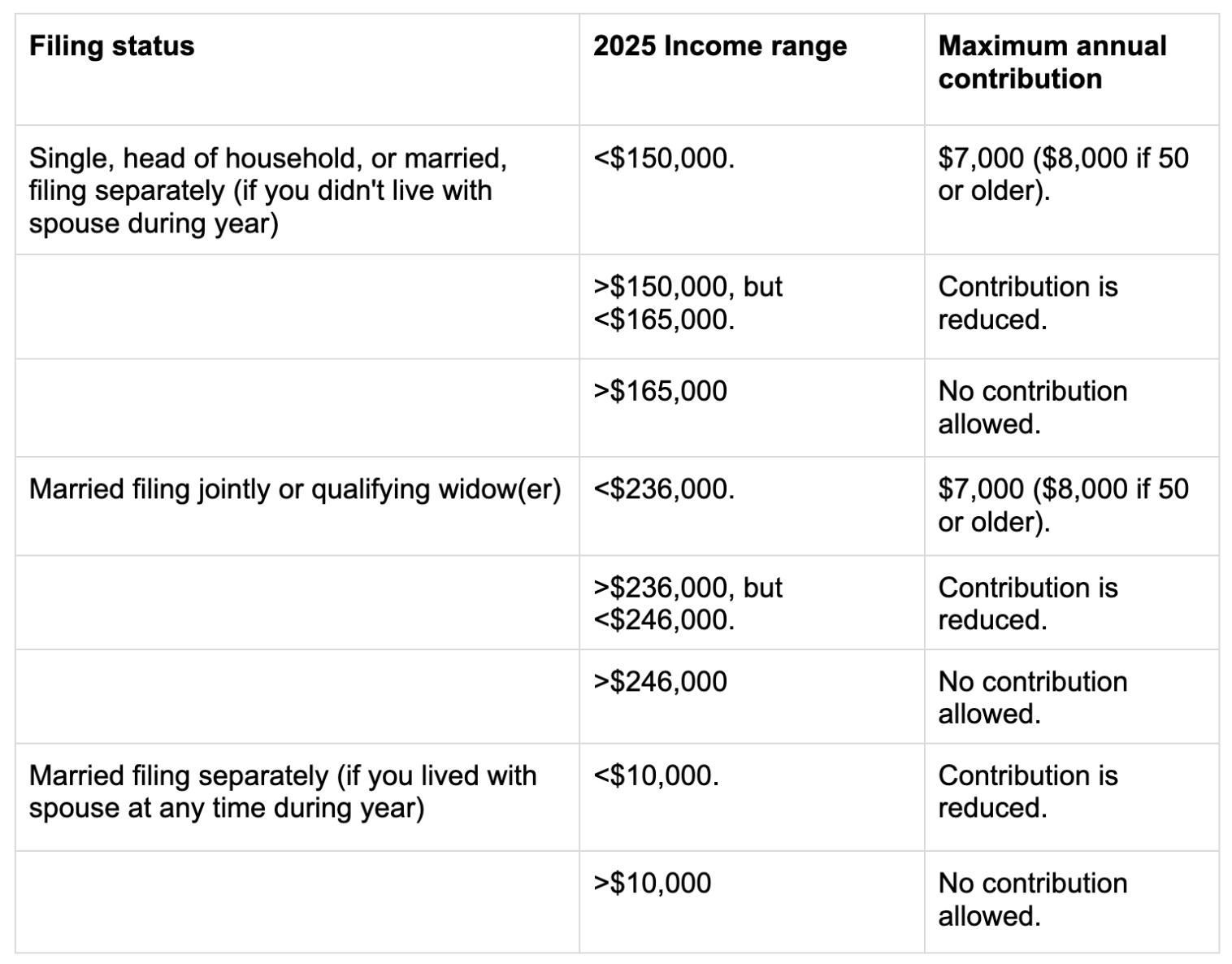

In 2025, the single income limit for investing in a Roth IRA is a modified adjusted gross income (or MAGI, like “we three kings”) of $165,000 ($246,000 if married filing jointly), but you can’t take that at face value.

(Reminder: If you’re filing for the 2024 tax year, the numbers are a little different. But if you’re looking ahead for 2025…keep reading!)

2024 Roth IRA income limits

Someone making six figures who also reads this blog is likely contributing the maximum to their Traditional 401(k), which means they’re probably claiming a deduction of $23,500 in 2025—which means they’d probably need to make closer to $188,500 single and $293,000 married in order to be totally phased out (because $293,000 married minus a $23,500 contribution for each partner is that upper $246,000 limit).

Why a Roth IRA is worth your time

Besides tax-free growth and withdrawals, the Roth IRA allows you to access the principal at any time before age 59.5 with no penalties (the growth on that principal is treated differently, though).

Because of this easy-access feature, Roth IRAs are a super flexible investment vehicle for retirement (and even more flexible if you’re planning to be an early retiree, thanks to the whole “no penalties on your own contributions before you’re gray” thing).

But what should you do if you’re unable to contribute to a Roth IRA because you make too much money? The Backdoor Roth IRA.

You should be able to pull this off without any tax penalties, but there’s one scenario to be aware of that might trigger a tax bill that I note at the end of the steps below. Make sure to read through to the end, because it will likely determine whether or not you choose to attempt this.

(You might also wonder if a taxable brokerage account is a better fit—and it might be, but think about the main similarity between a Roth IRA and a regular ol’ taxable investing account: You’re already using post-tax dollars. Where you may otherwise jump straight to taxable investing after your 401(k), this is a way to sock away $7,000 post-tax dollars in an account that’ll grow and be accessible tax-free forever.)

“Backdoor Roth IRA”: the TL;DR

In a Backdoor Roth IRA (the potential for sexual innuendos abound!), you create a Traditional IRA and make a non-deductible contribution (in other words, you’re using money you’ve already paid taxes on, which likely means it’s just the money sitting in your checking or savings account).

You’re probably like, “What’s the point of a Traditional IRA if the main benefit of the account doesn’t work for me?” But the ability to convert IRAs from Traditional to Roth is your bread and butter here.

Here’s how it works:

-

Open a Traditional IRA account with your brokerage firm of choice. Open a Roth IRA with the same firm, if you don’t have one with them yet.

-

Fund the Traditional IRA to the 2024 IRA contribution limit (assuming that’s your plan for the year): $7,000. Leave the funds in the money market/cash balance; don’t invest it yet!

-

Wait a few days for the funds to settle.

-

Convert the cash to Roth (big brokerage firms know how to do this; if you need help, you can ask! There should literally be a button that says “Convert to Roth”). Because the funds aren’t invested yet, there will be no gains to pay taxes on. You already have a Roth IRA ready and waiting from Step #1.

-

Invest in the index funds of your choice within the Roth IRA with the funds you converted.

And…that’s it.

There’s just one small snafu to note, per my earlier comments about being able to access contributions at any time: When you convert funds to Roth in the Backdoor Roth IRA process, you now have to wait five years before you can access the principal (hopefully this is no showstopper for someone with their other financial ducks in a row).

When does this make sense?

If you meet the qualifications above and you’re feeling comfortable so far, I’d consult an accountant for one last gut-check, then give it a go. However, one thing to note from a tax optimization standpoint is that this process should probably come after you’re able to contribute the maximum to your 401(k) for the year.

You can do them simultaneously, of course, but if you’re not getting the most tax-deferred bang for your buck at your income level, the Backdoor Roth IRA probably shouldn’t be priority #1, in my opinion.

When shouldn’t you do a Backdoor Roth IRA?

If you already have Traditional IRAs lying around like discarded Fiji water bottles (I assume you drink Fiji water because…well, you know), you’re going to be subject to this convoluted thing called the IRS pro rata rule, which will result in a tax bill.

I spent about an hour reading IRS.gov articles about this rule, and now, all I’m (kind of) confident about is this: The breakdown between your existing pre- and post-tax dollars in your existing Traditional IRAs will determine the amount of your Roth conversion that’s taxable.

>

“Depending on how much money you’ve got in those other IRAs, your tax bracket, and how much you’re trying to roll over, this could create a hefty tax bill come April.”

Yeah, I didn’t get that either. Let’s do an example.

If you already have $50,000 in a Traditional IRA that you created with deductible, pre-tax contributions (before you were a high roller) and you add another $7,000 post-tax with the intention of converting it to Roth, only about 11.5% of the total amount in your Traditional IRAs is post-tax ($6,555 of the $57,000).

As such, 11.5% of your Roth conversion will be tax-free—but you’ll be taxed on the other 88.5% of the conversion. If you’re in the 24% income bracket, you’d pay $1,570 in taxes on the conversion of post-tax dollars to Roth (the 88.5% of your conversion ($6,555) x 24%).

TL;DR: Depending on how much money you’ve got in those other IRAs, your tax bracket, and how much you’re trying to roll over, this could create a hefty tax bill come April.

For that reason, I’d really only attempt this (on your own) if you do not have a big balance in a Traditional IRA already (including SEP IRAs, rollover IRAs, etc.—and to be super clear, your Traditional 401(k) doesn’t count!).

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time