Our Combined Net Worth is More Than $500,000 – Here’s Why We Still Rent (and When We’ll Choose to Buy)

August 11, 2021

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

This is my fourth article about this topic, but who’s counting?

In the past, I’ve tried to present the most objective, data-driven, and math-backed explanations for why your primary residence is not an investment in the traditional sense.

When you look at the constant flow of cash outlaid to maintain a home (closing costs, agent costs, property tax, insurance, HOA where applicable, maintenance, and mortgage interest), it becomes clear quickly why the ROI isn’t very good – even if your property appreciates wildly.

But the funny thing about home ownership is that people take it really personally. When you point to the facts – to math – and say, “See? It’s not an investment if you purchase it for $400,000 and end up spending $985,000 over the life of your 30-year mortgage, on average!” Some people don’t take it very well.

And because I have a sick compulsion wherein I have to argue with every angry commenter who raises an objectively unfounded counterargument that ignores reality, I decided I needed to take (again) another approach. (I’m a pleasure to live with, in case you can’t tell.)

Rather than trying to convince anyone else that it’s objectively not a good way to build wealth, I decided that I’d tell you why we choose to rent instead.

Because half the time, the angry comments I get (always from people who don’t follow me, but rather stumble across my housing content out of context) seem to imply that I’m only pushing renting because I can’t afford to do anything else – when in reality, it’s actually my best option financially. Buying a home right now would hurt my financial goals.

I can’t take credit for my housing skepticism

When I was 23, I was hellbent on buying a condo.

I (erroneously) set my budget at $250,000, and decided a condo was my gateway to affluence.

At the time, I just saw that I was paying $900/mo. in rent, and saw the mortgage on $200,000 wasn’t too much more – I didn’t understand that owning property opens you up to a world of other costs (some predictable, some unforeseen).

My view was really simple, and probably flawed in the same way that most people’s view of ownership is flawed: One method of housing meant I was handing over $900 per month to a landlord, and the other option presumably meant my monthly payment would go directly toward paying something off that I’d own.

It seemed like a no-brainer…

Until I started reading personal finance books.

The first one I read, a cult classic by Ramit Sethi called “I Will Teach You to Be Rich,” mentioned almost in passing that your primary residence is a terrible investment.

Ramit, this millionaire money expert, rented by choice and had no interest in buying a home.

What the hell? I thought, Does he know something I don’t know?

I figured it may be weird personal preference, but then I noticed another prolific personal finance writer saying almost the exact same thing. JL Collins, writer of “The Simple Path to Wealth,” wrote that many people falsely believe their primary residences are investments. He clarifies:

“Your home is not an investment. It’s an expensive luxury.”

Okay, seriously, what gives?

It wasn’t until I read Kristy Shen’s “Quit Like a Millionaire” that all the dots connected.

In a few pages, she completely eviscerates the idea that home ownership is a wealth-building tool (chapter 9, pages 78-88 – these 10 pages will change your life if you’re gearing up to slide in my DMs with vitriol over these claims).

She breaks down – inch by inch – the conservative, average costs of owning a home, and how even hundreds of thousands of dollars of appreciation often isn’t enough to offset the costs the homeowners had to pay in property tax, mortgage interest, closing costs, and the cost to sell (because yes, even the cost to sell a home is usually 10-12% of the sale price paid to the seller’s agent and buyer’s agent – you lose 10% of the value in one fell swoop!).

Those few pages opened my eyes forever, and now I feel like I can’t un-see the Capital-T Truth.

But try telling that to someone who’s been told their entire life that owning a home is the American dream! The way to wealth!

They look at you like you’re QANON.

And I would’ve too, had I not seen the math – but what gets me riled up is people who, even after seeing the math, still insist that their house is different. That’s why I decided it makes the most sense (after posting the true mathematical assessments) to simply share why I’m not in any rush to buy a home.

If you spend much time in the personal finance world online, you’ll see that this opinion is not controversial. It’s not a hot take. Most money experts are in agreement that it’s a shitty investment – the rest of American society just hasn’t caught up to it.

(Keep in mind I’m speaking purely in financial terms: It may be an amazing investment in your mental health, your family, and your sense of security – just not your wallet.)

Reason #1: It’s not tax-efficient for us because we won’t be purchasing a home worth more than $800,000

One of the most surface-level arguments for home ownership is that it’s tax-efficient – like owning a home is good for your taxes.

But as with most things, it’s important to break that one down a step further.

Thomas and I are married filing jointly, which means our standard deduction – the amount that we get to deduct from our taxable income, like every other married couple that files jointly – is $25,100.

How do tax deductions work?

A tax deduction is basically the government just saying you don’t have to pay income tax on a certain amount of your income.

In this case, it means we get to keep $25,100 of our income, tax-free.

That’s the “standard” deduction – you can either take the standard deduction, or you can itemize your deductions. Most prospective homeowners are likely sold on the fact that they can “deduct” some of their costs! Woohoo! …but not so fast.

When you itemize your deductions, you forego your standard deduction.

That means – in order to decide that itemizing your deductions makes more sense than taking the standard deduction – you’d have to be spending more than $25,100 per year on certain aspects of your home. Which aspects, you ask?

Ah, only the unrecoverable costs – the ones that don’t build any equity anyway!

How great is that?

There are two things that you can deduct when you’re a homeowner:

-

Property tax

-

Mortgage interest

In 2018, the amount of property tax you can deduct was capped at $10,000.

That means that in order for us to benefit from the so-called “tax deductions” that you get as a homeowner, we’d need to be paying $10,000 per year in taxes and $15,100 in mortgage interest for it to be better than just taking the standard deduction.

$25,100+ per year in unrecoverable costs that don’t build any equity in our home, just to save a little on taxes.

That’s $2,091 per month in unrecoverable costs to get a tax benefit that everyone else gets anyway.

If you’re curious how expensive a home would have to be in order to be worthwhile for tax deductions…

-

Home price: $800,000 with 20% down, so a mortgage of $640,000

-

Interest rate: 3%

-

Property tax: 1.2%

(The above are national averages for interest rates and property taxes.)

In the first year (when you’re paying the most interest), that’s:

-

$18,996 of interest

-

$8,000 of property tax

-

Total: $26,996 that you can deduct, or about $1,896 more than what the standard deduction would give you anyway

Assuming you’re in the 24% tax bracket, that’s an additional tax savings of a whopping $455 per year – and you only had to pay $26,996 to get it!

We have no interest in buying a home anywhere near that expensive (because we can see how much the monthly costs increase when you do), so the tax efficiency argument doesn’t help us at all.

Summary: Renting and taking the standard deduction is more tax-efficient for us, since we don’t play to buy a home worth more than $800,000.

Reason #2: Since we know buying a home isn’t a good way to build wealth, we don’t want to spend very much

Ultimately, a home is a place to live. It’s shelter. A roof over your head.

We don’t believe that buying a big, fancy, expensive house a good way to build wealth, as all the data points to the fact that it’s not.

As a result, we’d want to spend as little of our total net worth as possible on a home.

Combined, we have approx. $500,000 in investments, roughly $350,000 of which we could access immediately and use (the rest is in retirement accounts that would be harder to access, though not impossible).

I wouldn’t be comfortable using any more than about $60,000 – or 12% of our entire net worth – on a down payment, which is 20% of $300,000.

(This is partially because property is one of the easiest ways for the government to actually tax wealth – if your net worth is tied up in your home, it means almost your entire net worth is being taxed every year. That’s incredibly inefficient, compared to traditional investments like stocks and bonds, and I’d like to keep my taxable property as low as possible.)

The total monthly payment of mortgage, interest, property taxes, and insurance on a $240,000 mortgage in Fort Collins, CO is $1,289.

I would be thrilled to pay $1,289 per month all-in, even if it meant I had to put $60,000 down first.

There’s only one problem:

There aren’t any houses I’d actually want to live in that cost $300,000 in our area.

The home we’re renting, for reference, is estimated right now at $850,000.

There’s no way in actual hell that I’d ever pay that much for a house, which is why we spend $3,000/mo. to rent it instead.

That’s where the rent vs. own conversation gets tricky, and it comes down to comparable houses: Could I buy something and spend less than $3,000 per month? Yeah, obviously. I could spend less than half each month!

…but not for a house I’d actually want to live in.

To get something for $300,000 in this area, you’d have to go out of this area or buy something really run down, in need of repair, and small.

I tried to find an example on Zillow to make my point, but the cheapest home in our zip code for sale right now was a 900 sf. 2BR condo listed at $480,000.

(To be clear, I’m not asking for pity – we choose to live here! We could move somewhere cheaper that’s not in Northern Colorado. But we also don’t live in San Francisco or New York City. Many traditionally ‘desirable’ places to live are experiencing this same effect right now.)

This is why I totally understand why people who live in low cost of living areas think I’m insane for renting a $3,000/mo. home and don’t understand how I could say that it’s the better option for me, especially if they have mortgages one-third that amount – you can buy a really nice home for $300,000 in many parts of this country!

…just not where I live right now, and that’s what ultimately matters to me.

Summary: Since a primary residence is not a wealth-building investment in the traditional sense, I don’t want to spend more than $300,000 – and there’s nothing anywhere near that price where I live that wouldn’t require a ton of work and money to renovate (or just be unreasonably small).

Reason #3: We plan to move every few years for the foreseeable future, and it’s hard to break even on a house before year 5

Right now, we live in Fort Collins for Thomas’s assignment in Cheyenne, Wyoming.

In two years, we’ll get moved somewhere else.

After that, we’ve talked (read: fantasized) about doing a stint somewhere in California, Hawaii, or New York.

The point is, for at least the next 4-6 years, we plan to be moving around.

We don’t know where we want to settle long-term yet, and when you buy a home, the early costs are so extreme that you typically don’t really break even until somewhere between years 5 and 10, depending on the market.

For example, let’s pretend that we did find our dream home in Colorado for $300,000 (not the 2BR dilapidated condo that it could currently buy).

When you get a mortgage, the lender front-loads the interest. For the first several years, the vast majority of our monthly principal & interest payments would just be interest – meaning we wouldn’t be paying down much of the actual loan and building lots of equity, we’d just be paying down the interest we owe.

We’d pay:

-

2-4% of the purchase price in closing costs (average)

-

3% interest rate on the mortgaged amount of $240,000 (average)

-

0.6% property tax (which is what I was able to find for Fort Collins online, which is a lot lower than where I used to live in Dallas, where property taxes are 2% per year)

That’s:

-

$9,000 in closing costs, conservatively

-

$14,000 in interest alone over the two years that we plan to live here

-

$3,600 in property taxes

Or a total initial cost outlay of $26,600 over two years of unrecoverable costs, or about $1,100 per month when averaged for our two-year stint in Fort Collins.

And how much equity would we have built?

Well, we put $60,000 down, so that’s great – we’ve got that.

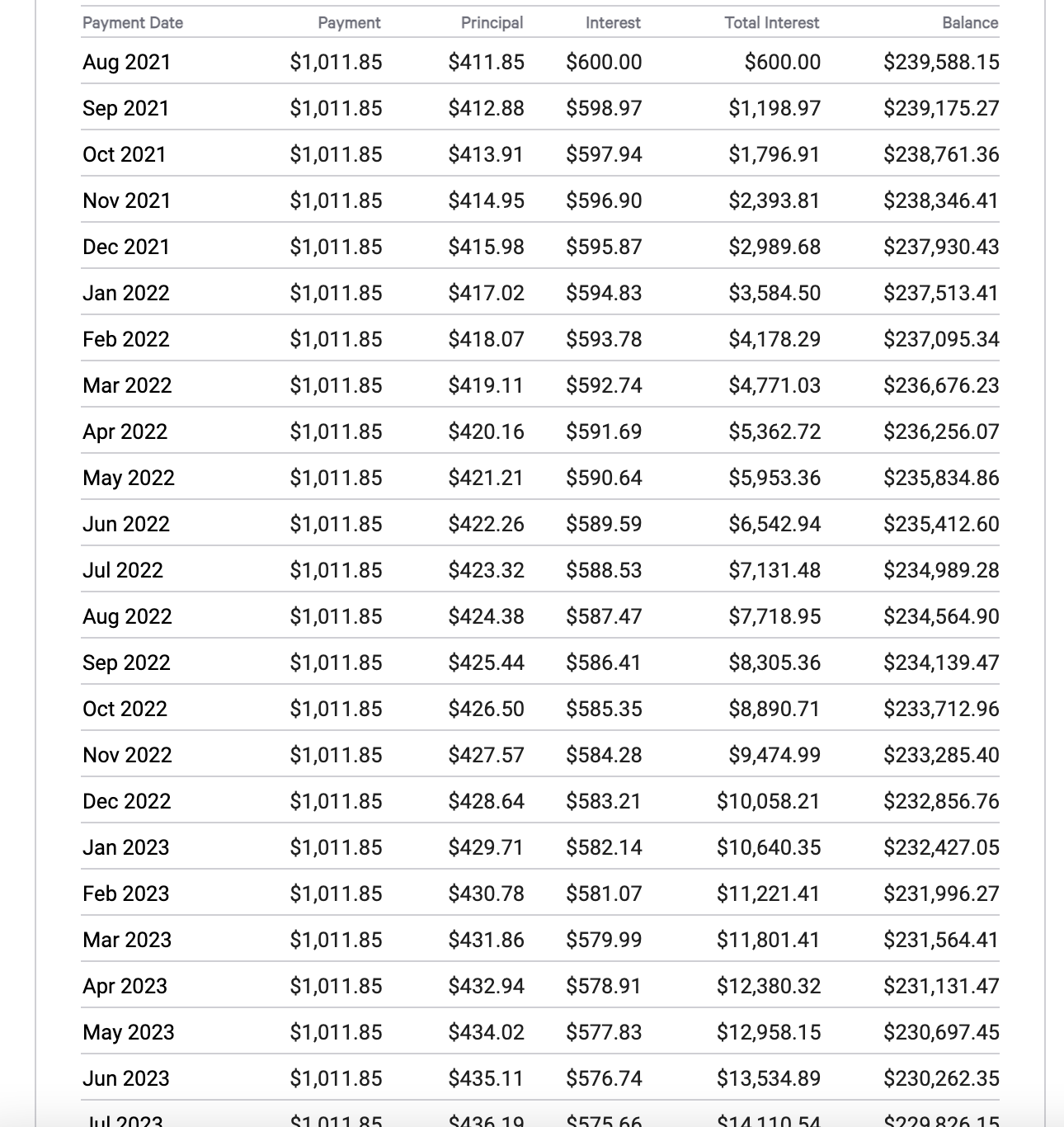

But in the two-year time span that we lived in this house and made payments on the $240,000 mortgage that we took out…

-

We’d still have $229,826 left to pay.

That’s right – we paid $26,600 in closing costs, interest, and taxes alone, and we only paid off about $10,000 in principal. That $26,600 doesn’t even include the principal payments.

See for yourself:

-

$26,600 of interest, closing costs, and taxes

-

$10,000 of principal payments

We’d pay $36,600 over the two years to build $10,000 in equity.

Even if the home appreciated by 7% per year over the two years that we live here (which is outrageously high), we would have spent:

-

$60,000 down

-

$26,600 in closing costs, interest, and taxes

-

$10,000 in principal payments

= $96,600 to live in the house for two years, or an average of $48,300 per year

If the home appreciated by 7% each year, it’d be worth $343,500 when we sold it.

After paying the buyer and seller agents their commission, as is customary for the seller to do (6%, so roughly $20,610 total), we’d have $322,890.

Give the bank their $230,000 that we still owe them, which leaves:

= $92,890

We would’ve spent $96,600 to make $92,890, assuming the home appreciates by 14% in the two years we live here, for a loss of $3,710.

Now, the obvious shitty thing about this is that the entire $36,000 that we spend in rent this year will be a loss – but it’s a $36,000 “loss” that enables us to live in a near-million dollar home with no pressure or consequence, not a $3,710 loss to live in a home that… well, wouldn’t get us much in this zip code.

And that’s assuming annual appreciation of 7% – the average in Fort Collins is 6% (the nationwide average is closer to 4%, but it varies a lot depending on location).

As the math shows, even great appreciation is not enough to offset the costs of a home if you only intend to live in it for two years, and right now for us, moving around is part of our lifestyle and something we enjoy and look forward to – buying a home would definitely put a wrinkle in that.

Even if we could get a home we wanted to buy (at $300,000) here and were comfortable with the conservative $3,000 loss when we’d sell in two years, the other thing that really bugs me about buying is the opportunity cost of the down payment.

That $60,000 down payment wouldn’t come out of thin air: It would come out of our investments, where it’s currently averaging 17% returns in the stock market’s bull run (also, I should note, outrageously high).

If the market delivers 10% average returns over the next two years, it would turn into about $72,000 if left in the market – which means our “true” loss isn’t just the $3,500 noted above, it’s $3,500 + the $12,000 the down payment would’ve earned in the market – a $15,500 loss over two years.

Which – again – is still a lot less than our outlay of rent over those two years ($36,000 * 2 = $72,000, yikes), but the fact remains that there’s nothing we’d be interested in buying at that price point in this part of town, which says more about the northern Colorado market than probably anything else.

Summary: We plan to move every few years for the foreseeable future, and you take the biggest losses when you sell a home after the first couple years thanks to closing costs and front-loaded interest on your mortgage.

Reason #4: We’re striving for financial independence, which is the number at which you can live off your investments indefinitely

Homes are an illiquid presence in your net worth, which doesn’t help us.

This is perhaps the biggest and simplest reason:

We’re trying to reach $1.5M-$2M in investments together as quickly as possible so we can withdraw between $60,000 and $80,000 per year to live on, tax-free – that’s between $5,000 and $6,666 of spending money each month, the latter of which being more than enough for our (current) lifestyle.

With a combined net worth of $500,000, we’re not super far away from being work-optional (even if we did have an expensive, infinite rent rate of $3,000/mo.).

Since homes are an illiquid asset (meaning you can’t spend your home’s value the same way you can spend the money in your investment account), having a lot of our net worth tied up in something we can’t spend doesn’t really help us reach that work-optional goal.

If we hit a work-optional FI number of $1.8M invested, we can withdraw $72,000 tax-free (thanks to long-term capital gains taxes) indefinitely – more than enough to pay our rent on a million dollar home, and all our other expenses, without having to work – leaving us free to stay home with our future kids, monetize hobbies if we want to, and more.

Putting down a bunch of our invested assets on an illiquid asset that we’d have to sell in order to use doesn’t really make sense for us and our goal of retiring in our early thirties, especially if we can support a renting lifestyle indefinitely and retain all the ease, flexibility, and low-maintenance attributes.

That’s not to say that we’ll never buy a home, of course – just that it doesn’t make sense for us right now for those four reasons.

So when would it make sense?

Here’s when we’d buy a house

I could see us buying a house if we decided to finally move somewhere to settle down for the next decade (and in a place where the cost of living was reasonable).

If we moved somewhere like the town I grew up in (Northern Kentucky) where you can buy a 5-bedroom home in a good neighborhood for $350,000, I’d be far more interested in doing so.

Realistically, I think what’ll likely happen is:

-

We’ll reach FI (or at the least, a seven-figure net worth) in 4-5 years from now

-

This’ll probably happen around the same time that we decide to settle down in one place for at least 10 years and start a family

-

Then, we can make a more accurate decision about how much we’re comfortable putting down, knowing that in the meantime it’ll lower our immediately accessible net worth

-

The lower monthly cost will offset the steep hit to the net worth

That would look like this, in practice:

-

Hit current FI number for the two of us: $1.8M

-

That produces $72,000 per year in tax-free income (4% safe withdrawal rate coupled with 0% long-term capital gains taxes)

-

Of that $72,000, $36,000 would go to rent (based on our current rent), which means the other $36,000 could go to discretionary expenses, or $3,000 per month in other spending

-

If we decided to spend $100,000 on a down payment (20% of $500,000), that would knock our net worth down to $1.7M

-

$1.7M produces $68,000 per year instead of $72,000

-

But the monthly cost of principal, interest, taxes, insurance, etc. on a $500,000 home with 20% down is only $2,200 per month, thereby lowering our monthly housing costs by $800, or $9,600 per year

That means… drumroll please!…

While we’d have to put $100,000 of our $1.8M down and lower our net worth accordingly, we’d ultimately be spending $9,600 less per year, while only generating $4,000 less in investment income.

…which would be a net positive of $5,600 per year, in this perfect mathematical vacuum.

This is the magic of waiting to buy a home until you’re already relatively wealthy – you don’t chop your fledgling wealth snowball in half early on to buy an illiquid asset. You let that snowball grow and grow, then shave off a corner to buy the house.

The bottom line

Eventually, it’ll make more sense to own a home – once we’re at FI (or close to it), in a place where we’ll be sticking around for a while, and hopefully have access to more affordable housing, it’ll make more sense for us to buy than to keep renting.

The cool thing is, we could keep renting indefinitely if we decide that that just works better for us. Some people (like Ramit) intend to rent indefinitely.

But right now, buying a home would actively detract from our goals, not help them, and ultimately, that’s what this decision comes down to for us: What gets us closer to our goals?

If our goal were to own a big, fancy house, we could go ahead and do that – but that’s not our goal. Our goal is to create lifestyle flexibility by being work-optional and living in a nice place, and right now, renting is what’s best for that goal.

How I’m still investing in real estate despite not owning a home

The funny thing about real estate is that it makes for a pretty suboptimal investment if you intend to live in it, but a pretty great one if you’re using it for cash flow (rental income, forced appreciation through repairs, etc.).

But being a landlord isn’t really my thing at this stage in my life, so I was interested in finding another way to make it work. I decided to start with a $5,000 investment in Fundrise (their “Core” level), which effectively invests your money in dozens of private real estate deals that their team puts together.

The statistics are pretty compelling: private real estate is an alternative asset class that has outperformed the stock market in the last 20 years, with less volatility – that’s ultimately what convinced me to diversify with private real estate (again, without having to become Myrtle the Landlord).

You may also like these posts:

-

Why I Don’t Include a Primary Residence in Net Worth for Financial Independence

-

How to Consider a Mortgage in a Financial Independence Calculation

-

When the Math Supports Buying Your Primary Residence Instead of Living in It

Disclaimer

I’m an investor with Fundrise. I asked them if they’d be interested in sponsoring this post, and they agreed. I don’t receive any commission if you sign up.

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time