Best Temporary Perks for the Platinum Card® from American Express Right Now

August 3, 2020

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

August 2020

This view has become all-too-familiar.

Disclosure: This content is not sponsored or endorsed by any of the card brands described here and is accurate as of the posting date, but some of the offers mentioned may have expired. Money with Katie is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com. This compensation may impact how and where links appear on my site, and this site does not include all financial companies or all available financial offers.

I refuse to begin another travel card article with a reference to how things are “paused” right now because I’m committed to getting creative and maintaining some semblance of a “regular” travel schedule as the months of sitting around the apartment start to span closer and closer to a year.

That said, in some ways, we’re lucky that issuers like AmEx are scrambling to justify their value (another bonus – more generous retention departments).

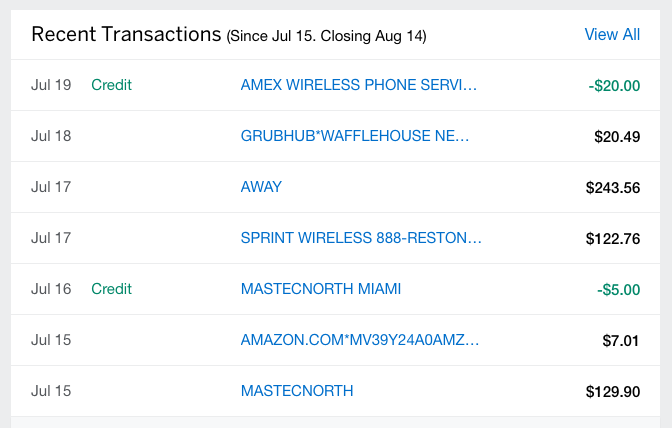

A few weeks ago, I was pleasantly surprised to see a few monthly reoccurring charges on my Platinum card get fully or partially reimbursed. Check it out:

Kindly ignore my $20 GrubHub purchase of Waffle House; I am weak.

The purchase on July 17 for Sprint Wireless ($122.76) is my monthly cell phone bill for my phone and my dad’s phone (he Venmos me every month; we have effectively switched roles in our relationship). A few days later on July 19, AmEx reimbursed me $20 for the charge.

Starting in May, American Express announced that they’d apply a $20/mo. credit to eligible wireless plans (AT&T, Sprint, T-Mobile, Verizon), and last month I finally got around to switching my Sprint autopay from my Sapphire to my AmEx. That’s the stupidly simple headline here:

This only works if you remember to actually use your AmEx for the purchases – and for me, that required taking some inventory and making some swaps.

For those of you whose parents still love you and pay for your cell phones, this might not be applicable – but there’s also a $20 credit available for streaming services, including some of the most popular:

-

Amazon Music

-

Apple Music

-

Apple TV+

-

Audible

-

Disney+

-

ESPN+

-

HBO Now

-

Hulu

-

Netflix

-

Prime Video

-

Spotify

-

YouTube Music/TV

…and others.

Between now (August) and December when the credit is currently set to expire, you could reap $200 in total value in the form of kickbacks for paying for services you already use. For me, this entirely covers the cost of my Spotify (which is usually $10/mo.). If you don’t have one of these services but you’ve been wanting it, you could always find one that costs $20 or less, sign up through the end of the year, and let AmEx foot the bill.

Another fun note for my fellow Sprint people: (a) We’re part of a hardened crew who has opted to suffer shittier service in exchange for cheap, unlimited data, and I salute your sacrifice, and (b) Did you know you get Hulu free with your data plan? My basic Hulu membership is covered by Sprint every month. Loopholes on loopholes.

Here’s the thing: My gut instinct is that these perks are going to get extended and maybe even improved. These card companies are sitting on mountains of cash and they want to keep their spend-y members. I’ll keep y’all posted on updates.

Other cool perks right now

Another fun one I’ve been using is the complimentary free year of Calm Premium, the meditation app. They’ve got some nice sleep meditations and a starter course, but honestly, I’ve been a little frivolous with my self-care budget and I paid for a month of unlimited classes at a meditation studio nearby so I haven’t used it as much as I initially thought I would.

Of course, the regular Platinum benefits can be applied right now too: The annual $200 Uber credit probably isn’t very helpful for the same reasons it usually is (delivering you to the front door of happy hour spots, speeding to the airport so you don’t miss your flight… ugh, I weep), but – drumroll please – UberEats counts! Just remember to tip well because #karma. This is a use-it-or-lose-it benefit with a $15/mo. Uber Cash allowance ($30 in December), so go nuts.

Lastly, it’s the second half of the year, which means two things: the Platinum Saks Fifth Avenue biannual $50 shopping credit, and the second time in the year where I navigate to Saks.com, click “Sale” and filter by <$50.

Finally, if you don’t have Global Entry, AmEx covers the $100 application fee. Won’t it be nice to have Global Entry (which includes TSA Precheck) locked and loaded by the time you can start traveling internationally again?

Summary value breakdown

Between now and December, if you were to apply for the card and only leverage these perks, you could recoup up to $409.99 in value:

$50 Saks credit

$100 (five months of streaming credits)

$100 (five months of phone credits)

$90 (five months of UberEats credits)

$69.99 (complimentary year of Calm)

…and that’s without stepping foot on an airplane or taking a single trip.

Final assessment

My take is, if you think you’d take advantage of the services above, this is a worthwhile card to keep (or obtain) despite Coronavirus. Even if you only have one trip planned for this year, if it involves an airport with a Centurion Lounge (assuming they reopen), I think you’d be glad you did. AmEx has done a pretty good job of amping up the temporary bonuses, which is fair considering the high cost of the card.

Learn more about the Platinum card

Editor’s Note: Opinions expressed here are mine alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved, or otherwise endorsed by any of the entities included in the post.

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time