What to Do if You Get Rejected for a Premium Card: A Personal Case Study

September 14, 2020

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

Advertising Disclosure: This content is not sponsored or endorsed by any of the card brands described here and is accurate as of the posting date, but some of the offers mentioned may have expired. Money with Katie is part of an affiliate sales network and receives compensation for sending traffic to partner sites. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

#

Rejection is never fun, but it’s slightly less painful when you can turn it into #content.

That’s right, my friends – * clears throat * – my application for the Chase Ink Business Preferred card was turned down. The smallest violin has been hosting a concierto ever since I got the news, which was approximately 3 minutes after I submitted the application. It told me that my application had been rejected and that I’d receive an explanation via mail in a few days.

Stunned, I stared at the plain text announcement that might as well have said, “We’re on to you and your hoax-y ‘business,’ Gatti, and we’re not forking over 100,000 more points.”

Hardly accepting of a flat-out “no,” I began immediately Googling my next options. How could this be? I’d been staging my coup on the coveted Ink Business Preferred for a little under a year, and when I saw the sign-up bonus had skyrocketed from its already-generous 80,000 points to its staggering 100,000, I had practically stumble-clicked my way through the application in a haze of furious greed.

Turns out, there’s this thing called the reconsideration line. Here’s what I did.

How I appealed my credit card rejection

Located the reconsideration line phone number and read an embarrassing number of how-tos from the points pros

A lot of the tips were pretty damn obvious (“Be nice!”), but a few were ostensibly helpful – it’s bad form to mention the sign-up bonus in a reconsideration conversation, but you can (and should) mention the reasons why you want the card (apart from the utter motherlode of free travel).

The cute and fun part of this story that makes it helpful is that I ran into roadblock after roadblock throughout my journey.

Since I was applying for a business card, I found the business-specific reconsideration line (or so I thought) at 1-800-453-9719, that apparently operated Monday through Friday from 1-10 p.m.

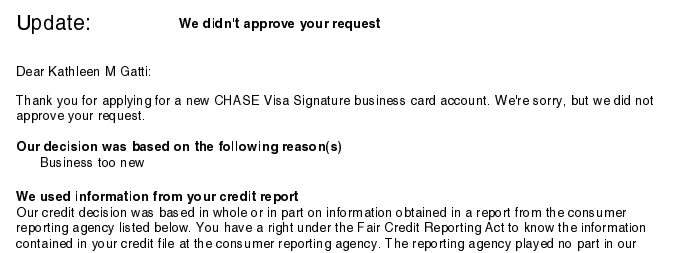

Luckily, I didn’t have to wait several business days to read my rejection in print. It came as a secure message in my Chase account the same day. I secured the reference number from the document and wrote it down, since I figured I’d need it during my call (if you’re in the same boat and you have an existing Chase account, navigate to the hamburger menu on your computer, click “Statements and Documents,” then “Notices and letters” – it should be waiting there for you like a turned-down invitation to homecoming).

Evidently, my hardly existent business was also too “new.” Interesting. I could work with that.

I took my laptop and phone out to the pool, so as not to disturb my roommate (or embarrass myself whilst pleading my case) and dialed the number, exhaling sharply when the automated voice politely invited me to enter my 12-digit reference number.

So far so good, I thought.

“We’re sorry,” she retorted, as soon as I had finished. “That reference number cannot be found.”

“What?!” I shrieked. I hung up and tried again. Three times.

Still no dice.

I did what any good nascent Karen would do and turned to Twitter customer service instead. A few hours passed, and they finally replied to let me know they couldn’t handle this over social media and I’d have to call.

“I’m happy to call,” I responded hastily, “But I’m hitting a roadblock because my reference number won’t work. Can you please provide a different number so I can talk to an agent?”

They gave me a number for “card lending services,” at 888-609-7805. I strapped in, ready for a long wait.

The same prompt for the reference number replayed, and I obliged, half-expecting it to kick it back to me. After a few moments, a real human named Francisco was on the line with me. Showtime.

I explained I was hoping for reconsideration on my recent card application and that I’d be happy to answer any questions. He pulled up my application and re-explained their reasons for rejecting it, then said he could review it again. I asked him if I could explain.

What did I say on the call with the rejection appeal line?

This is an exact script. I literally read this from my computer screen to Francisco, because I planned it ahead of time. That’s the confidence with which you want to enter a reconsideration call (not that it mattered, since I was declined again, but I still think I did a bang-up job otherwise).

My business is a travel blog that I operate out of my home, and I’ve been doing it for a while, but I really doubled down on it in April – which is why I put April 2020 as the official business launch despite the fact I’ve been doing it for years. I work for Southwest Airlines full-time, but I’m ready to invest more in the site as a small business. The primary source of income will be affiliate revenue, but I know I’ll need to spend time and money in order to grow it to that point.

I love my Sapphire Preferred card, but it’s 2x points on travel, and I’d love to get 3x with the Ink. Because I’m starting to see some traction with the site and investing more in it with advertising on social media and in Google, I would really like to put that spend on a proper Business Card and get 3x points for those purchases as well. Same with paying for my Internet at home.

I understand that you may be hesitant to extend me another new line of credit, and I’d be willing to shift some of my credit from my Sapphire, Bonvoy, and Southwest cards to the Ink Business Preferred if you’re willing to reconsider.

I practically bowed as I finished.

“Well, ma’am,” he replied, unimpressed, “Since this is a business card and those are personal cards, I can’t transfer any of the credit.”

Damn it. I figured that would be my golden (blue plastic) ticket.

He asked if he could have 3 to 4 minutes to review my application, and I nervously browsed the internet without actually reading anything I was looking at. He came back and asked a few more questions.

-

“You stated you began blogging before April. When did you first blogging?” I told him 2015, which is true.

-

“How much do you anticipate you’ll make over the next year from your business?” This one induced panic and I told him I wasn’t really sure. “A few thousand?” I asked.

He requested 3 to 4 more minutes.

Finally, after an eternity of insecure pacing, he returned to tell me the application was declined again for two primary reasons:

-

Evidently, they’re using some credit reporting service that would only return a result for businesses that officially file taxes, it appears.*

-

Update from Future Katie: I believe the real reason this request was denied was because Money with Katie was not yet a registered LLC with an EIN, which is all but necessary for being approved for business cards these days. I used Stripe Atlas to register mine and handle all the paperwork for about $500.

-

-

I have too much available credit with their bank already and I’m not using enough of it every month (this is where a shift of credit to a new card would’ve been ideal, but I guess you can’t mix business with pleasure) #SAD.

Why did I get rejected for a premium credit card?

I had heard and read for years that the Ink Business Preferred was given away like a free carwash coupon for anyone with the audacity to operate a lemonade stand. I couldn’t believe the scrutiny that my (somewhat legitimate but mostly not) “business” was undergoing, especially since nothing I said was really even a lie – I do want to grow my site, and I do intend to spend more on it.

After a little more research, this is what I found:

Credit lenders are tightening the purse strings right now because the economy is in a recession and credit risk is much harder to assess with so much unpredictable unemployment. The credit score reported on my rejection letter was 800+, so I know my score had nothing to do with it.

TL;DR: It’s way harder to get approved for credit cards than it usually is right now, especially business cards, because banks are being more stringent with their qualifications.

From this point, I could call again and hope to speak to a different representative, but I don’t think the outcome would change since they’re evidently using a particular credit reporting feature that doesn’t have anything on record for the illustrious www.moneywithkatie.com brand.

How you can appeal rejections for personal cards

All that said, don’t let this dissuade you from applying for credit cards right now – especially personal cards. The worst that can happen is a “no.” If you experience rejections for personal cards over the next few months, I think you’ll have a much easier time of pushing back than I did.

One thing to note: Applying for a lot of new credit over a short amount of time (within a couple years), especially with Chase (who has the best array of travel rewards options, in this reporter’s opinion, but is quick to cut you off from the sweet teat of free travel), will raise red flags. This is where offering to move credit from another card is a helpful tool to employ, if you’re comfortable with it. This basically means if you have three cards with a $12,000 limit each, you’d take, say, $3,000 from each (dropping all three to $9,000) and putting $9,000 on a new one. That way, Chase is still lending you $36,000, but you’re spreading it across four cards instead of three.

However, if they ask you to close a card, I’d be hesitant unless it’s truly one that you don’t use very often. Remember, closing a card isn’t good for your credit score, and it can hurt your average age of credit if it’s a card you’ve had for awhile.

Reasons you might still be rejected for a premium card

So let’s say you’re interested in one of my favorite and most-used cards, the American Express® Gold Card, a premium card I love because it allows me to earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide up to $50k in purchases per calendar year, then 1x points, and at US supermarkets, up to $25,000 in purchases per calendar year, then 1x points. (Also, you may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount–all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.)

There are a few reasons you may be rejected, most commonly that you’ve applied for too much new credit recently or have a credit score below the “Good” or “Excellent” FICO range.

This becomes more explicitly troublesome with Chase cards. If you’ve applied for five credit cards in the past 24 months (with any bank), you’re officially in violation of the Chase 5/24 rule that says it won’t approve a sixth line of credit in two years. The 5/24 rule was instituted in 2015, I believe, to alleviate credit card churners from pillaging the sign-up bonuses and canceling the cards then repeating the process.

I’ve heard of some workarounds (like applying through the pre-approved “Just for you!” offers), but even those are becoming increasingly difficult to swing as the economy plunges deeper and deeper into a black hole.

Obviously, a credit score under 700 will also make it more difficult #InThisEconomy, but unless you’re below a hard cutoff, it doesn’t hurt to call and plead your case.

A few things to mention (assuming they’re true) on a reconsideration call for a personal card:

-

Note if you’ve never made a late payment

-

Note how long you’ve been with the bank (a lot of people have Chase bank accounts; you can say you’ve been a customer for X years and use the checking & savings products as your primary accounts)

-

Note if you pay your bill in full every month

-

Note if you intend to do a lot of traveling soon and you want to get 2x (or 3x, or 6x, whatever the case may be) points on your purchases at a certain airline, hotel, or both

The Chase 5/24 rule is the reason you should apply for Chase cards first (with the exception of the Platinum, in my opinion) before you switch to other banks (like the Citi American Airlines card, for example). If you stock your wallet with 5 Chase cards first, you can then move onto other lenders without incident (assuming you’re doing so with 3 or so months in-between acquisitions).

Final conclusion

Try anyway. Apply for the cards you want. If you get rejected, implement some of the tricks above, and if you still get rejected, you’re in good company.

When the economy turns around in a few years, maybe I’ll try again… assuming there’s a fragment of society left in which to travel.

*Update from the Great Beyond: I reapplied for the card several months later after I had registered Money with Katie as an official business with an EIN (the equivalent of a business Social Security number). Good things come to those who wait…and register with the IRS.

#

Editorial Disclosure: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Paragraph

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time