How I Can Easily Justify the $550 American Express Platinum Annual Fee (and Prefer it Over Chase Sapphire Reserve)

April 28, 2021

The Wealth Planner

The only personal finance tool on the market that’s designed to transform your plan into a path to financial independence.

Get The Planner

Subscribe Now

Biggest Finance Newsletter for Women

More than 10 million downloads and new episodes every Wednesday.

The Money with Katie Show

Recommended Posts

The fine print, since we’re talking about a credit card and I’m using an affiliate link: This post is not sponsored or endorsed by American Express. Money with Katie is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as Milevalue.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Recently I posted about The Platinum Card® from American Express, and I received an incredulous DM:

“Wait, I can’t imagine you’d promote this card unless you actually thought it was worth the insane annual fee, right?”

You are correct, my friend.

I went to send her a quick post that outlined why the AmEx Platinum is worth its weight in… platinum, but realized – with great horror – that while I’ve written articles about the Platinum before, I’ve never expressly written about why I think it’s easily worth the $550 annual fee (and then some) per year (Rates & Fees).

When I first got the Platinum card, I treated it like an experiment

I’ll admit, I was skeptical. Friends and coworkers swore up and down that I wouldn’t regret it, but I wasn’t convinced. I decided to take the plunge when I received a targeted 100,000-points offer in the mail, and treated myself like a human guinea pig.

I’ll just keep track of all the value I get from this thing over the next 12 months, and if it far surpasses $550, I’ll keep it, I reasoned, And if it’s a total loss, then at least I know for sure and I’ll just cancel it and move on with my life.

Long story short is, I stopped keeping track when – after about six months – my tally for benefits had already surpassed $2,200.

It’s one thing to just take my word for it, and quite another to see it in action. Let’s begin!

(Unfortunately, I don’t have the original list anymore – but I do have a pretty good working memory of the types of things we were getting a lot of value from. The other thing worth noting here is that American Express did a truly outstanding job with amping up their unrelated-to-travel credits and benefits during the pandemic, so I’m going to assess 2019 and 2020 separately.)

2019 – before the world shut down

Airport lounges

In a pre-Coronavirus world, I traveled constantly. We went on at least one trip per month; I think I went on 19 total in 2019 (including two to Mexico and one to Amsterdam).

Almost every time I flew out of an airport with a Priority Pass or Centurion Lounge, I’d stop and eat a full meal and have at least two drinks – so would Thomas, or whoever was traveling with me.

I value this at about $30 per person, per trip to the lounge, since that same experience (a meal and two alcoholic beverages) in the non-lounge-y part of the airport would probably cost about $30 after tip.

The Centurion Lounges are like a secluded haven tucked away above the terminal with lush couches, dining, meeting rooms, and in some cases free massage and manicures. It sounds stupid, but it really enhances the travel experience because you want to get to the airport early and hang out, eat, drink and relax before a flight (or do so for free after you land).

While only major airports have Centurion Lounges (specific to American Express), the Priority Pass lounge system is pretty ubiquitous – most airports have at least one – and Platinum gets you free access for you and your guest (enrollment is required, so don’t forget to enroll first!). This is a really great way to become someone’s favorite travel buddy.

I like to list this one first because it’s a distinct difference from the Sapphire Reserve card (the Centurion Lounge, that is) and, in my mind, a differentiator.

Fine Hotels & Resorts Collection

This is one of those benefits that you can milk for a lot more than $550 depending on how much you travel.

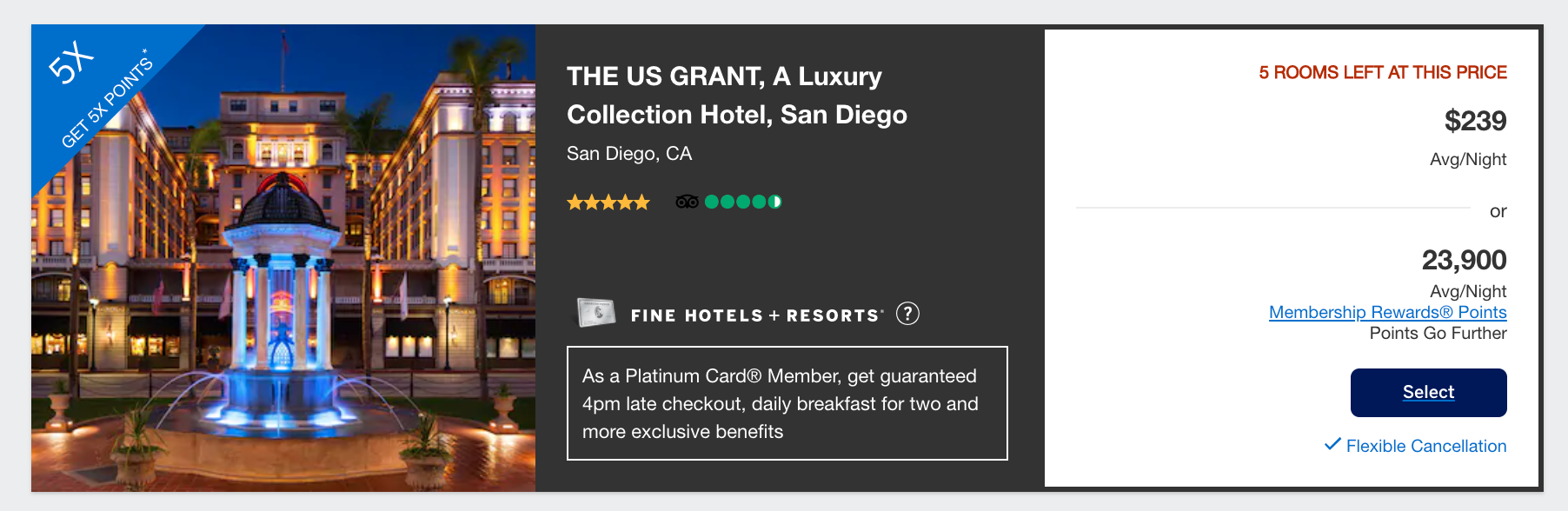

For example, in 2019, we stayed at a 5-star hotel in San Diego called the U.S. Grant – I booked it in the American Express travel portal with points, and it was designated a member of the “Fine Hotels & Resorts” collection. See below:

It’s designated with this dark gray treatment and the Platinum Fine Hotels + Resorts logo – the hotels that get this distinction are almost always five-star properties. Notice that the point valuation is really strong here, too – $239/night or 23,900 – hotels in the FHR collection are typically priced this way, where each point is worth 1 cent (that’s pretty good).

The real kicker comes when you get there – you get guaranteed late checkout, (usually) early check-in, a $100 “resort credit” which is usually agnostic as to where you can spend it (we usually spend it at the restaurant) and daily breakfast for two valued at $75/day.

If you stay at a hotel in the FHR collection for three days, that’s $325 in value in one trip.

This is another big differentiator (for me) between Reserve and Platinum in ongoing, repeatable value.

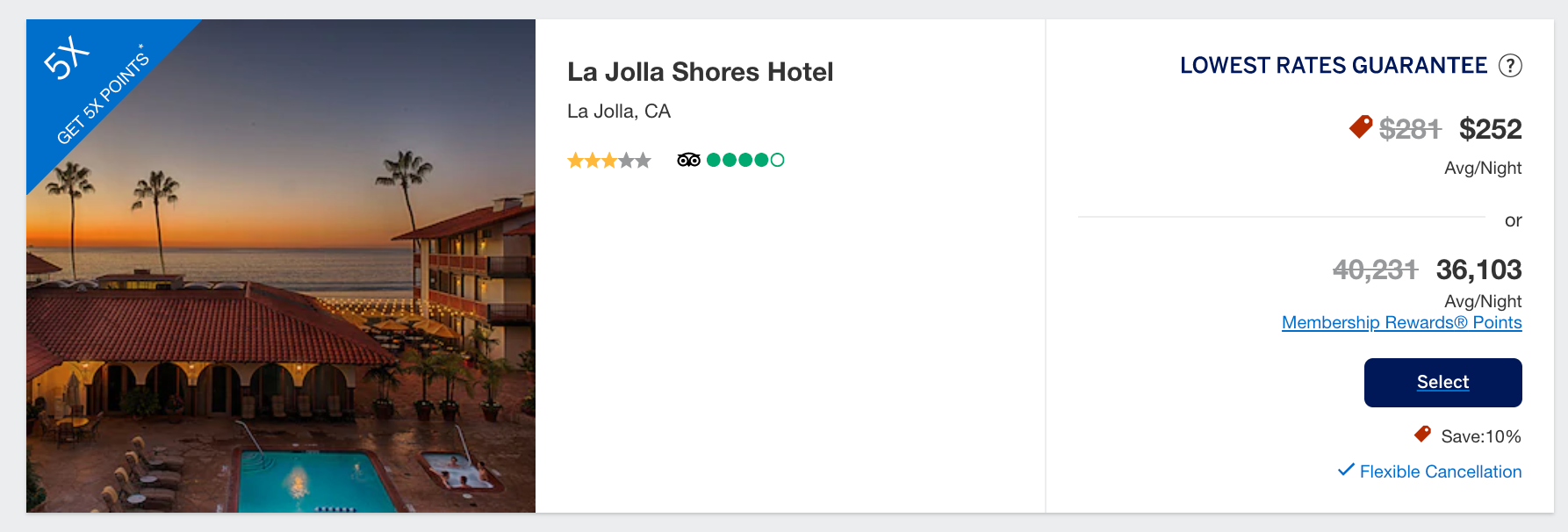

Since the rooms are priced a little better (points-wise), they tend to always be a great redemption value. Check out this hotel that’s not FHR for comparison:

Even though this hotel is almost the exact same price, it’s 36,103 points per night, instead of 23,900.

We’ve stayed in (if memory serves) three FHR hotels:

-

The U.S. Grant in San Diego, pictured above

-

The Cosmopolitan in Las Vegas

-

The Keystone Lodge & Spa in Keystone, Colorado

Each time, we used our $100 resort credit at a restaurant or spa, and took full advantage of the $75 daily breakfast credit (the cool thing is that you can pretty much use it for lunch, too, if you decide you don’t want to eat a big breakfast). I like to call the front desk and ask which restaurants on the property (if there are more than one) will receive the credit to be sure.

I would guess that we got $600 in value alone from this benefit.

Benefits where enrollment of some kind was required

All the benefits listed below required me to either (a) enroll in the benefit outright or (b) create and link a card or account, so be sure to check out the “Benefits” section of your account if you end up applying and getting approved for the card. Here’s a smattering of the ones from which I got the most value.

Up to $200 annual Uber credit

The annual Uber credit is $15/mo. (and $30 in December) to be used for Uber or Uber Eats. I love to use it as a “treat myself” takeout night and usually try to keep the charge at or around $15 so I don’t pay anything out of pocket. This one is a guarantee; you don’t have to go travel to use it (though I probably wouldn’t get this card unless I traveled a fair bit, since that’s really where it shines).

Up to $200 annual airline incidental credit, though this is being phased out

This one used to be way more valuable, because you could literally buy an airline gift card and get reimbursed as if it were an “incidental.” Unfortunately, they’ve caught onto that.

In 2019 I chose American Airlines as my “airline of choice” for the credit (it’s annoying, but you have to pick one) and would use the incidentals reimbursement for things like picking my own seat (booking a lower class fare and then paying for the better seat on the seat map), buying WiFi inflight, inflight meals and drinks and – God forbid – reimbursing a change fee.

Because I have Southwest Companion Pass (and about 210,000 Rapid Rewards points) this year, I designated Southwest as my airline of choice for the credit – that means when I book in points, the “$11.20” in round trip taxes & fees gets reimbursed by AmEx. This means my flights are totally, 100% free now, which is a pretty dope echelon of travel hacking to have achieved (please hold your applause).

I haven’t tested this myself, but I think it would reimburse other Southwest ancillary purchases, like EarlyBird automatic check-in and Upgraded Boarding at the gate (I use my Southwest Premier card for Upgraded Boardings; you get four free per year).

The point is, this one used to be a little easier to use, but it’s not value-less – just a little less straightforward. I’d probably value this one at around $100 in actual value because (unless you’re actually charged a big fee or need to check bags a lot) you probably won’t use the full $200 reimbursement, which is why (in my book) it’s not too devastating of a value to lose (as I don’t believe new cardmembers will get it).

Up to $100 annual Saks Fifth Avenue credit

Because I wholeheartedly dislike fashion and shopping now (it just felt like a rat race I couldn’t win so I gave up), this one isn’t as exciting to me – but it comes in handy if you want to get a new pair of shoes, a fancy skincare product, etc.

It’s issued in the form of $50 in the first six months and $50 in the second six months, and you’ll be reimbursed up to $50 in each half of the year for purchases at Saks.

If you’re the type of person who would spend money at Saks anyway, this one will definitely be valuable.

Up to $100 Global Entry reimbursement

I finally got Global Entry (applied in 2019 but didn’t actually get my appointment until 2020 thanks to the government shutdown in early 2019, #TBT), the cost of which is $100 – and AmEx reimbursed it. They’ll also reimburse TSA PreCheck, but since Global Entry is inclusive of TSA Pre, I went for the big guns (is it weird to call an airport security feature “big guns”? Probably).

Marriott Bonvoy Gold Status

This one is harder to quantify but has come in very handy for us. Since we also have Bonvoy Boundless cards, we stay at Marriott properties a lot – but the Bonvoy cards only come with Silver status, and the good benefits don’t start until you hit Gold.

With the Gold status, we pretty much get a room upgrade every single time we stay at a Marriott (in the Cosmo, for example, it was a room that was $100 more per night; in the Ritz St. Thomas, it was a room that was nearly $300 more per night), so if you’re onboard with quantifying the value difference in the room upgrade, there’s another easy few hundred dollars right there.

In practice, it just means you can book the “cheapest” Marriott room with your Bonvoy points, then show up and get upgraded to a Suite because of the Gold status your Platinum card gives you.

This is another differentiator for me from Sapphire Reserve and a big reason why I think Platinum is superior; there’s no automatic hotel status with Reserve.

Keep in mind that was a long list of things wholly apart from the welcome bonus

…but man, did I use the shit out of that welcome bonus! For the purposes of this post, I’m not going to mention the value of the points much, since I want you to see the ongoing value vs. a big one-time points bonanza.

2020, when Platinum pivoted hard on their benefits

The hilarious thing about 2020 is that I think I actually ended up getting more value from my Platinum card, not less.

(That might be an exaggeration, but it certainly didn’t go to waste.)

Because those categories were temporary, I’m not going to rehash them here (this post does a little deep dive into how they responded and which categories ended up getting credits, like streaming, cell phones, etc.), but my major takeaway was that AmEx wasn’t playing around with their #COVIDPerks.

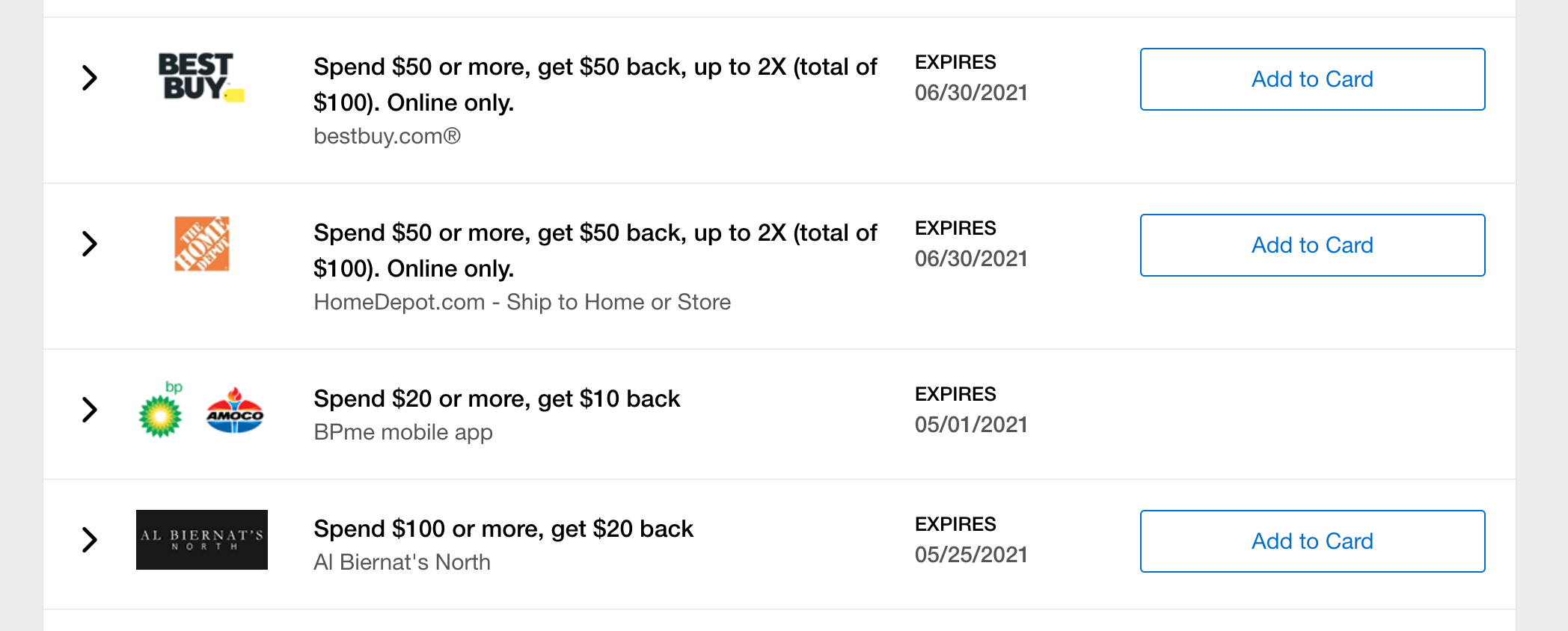

They also upped their game with the less-popular-but-still-super-valuable “Amex Offers & Benefits” list, an area in your account where you can “add” certain seasonal and temporary rebates to your card. In 2020, one benefit was “$100 off at Dell,” so I used it to buy a $140 monitor for my home office.

This is a great example of how they work, and I should really be better about checking back to see new ones – in this case, you’ll see you can get essentially $100 back at Best Buy and Home Depot through June, $10 off $20 of gas at BP, etc.

I wish I had kept up my tracking exercise for the last two years, but consider it a good thing that I didn’t – I was so convinced that it was worthwhile that I abandoned the spreadsheet because it no longer felt useful. That’s saying something.

2021

One thing I’ve already noticed in 2021 is the addition of a “up to $200 back” credit in the AmEx Travel Portal. I used mine already (LOL) to book a premium SUV rental car for our Colorado trip – and now AmEx will reimburse that purchase.

I paid the fee like a good little girl in 2019, but in 2020 (pre-pandemic), I wanted to try negotiating my way out of it (as a thought experiment, you know?).

It worked. Here’s how. While this probably won’t work for your first year of card membership, I think it’s worth a try in year two.

New cardmember perk

Right now they’re offering 10x points on U.S. supermarkets and U.S. gas stations for new cardmembers for the first 6 months of card membership, up to $15,000 of combined spend (and I’m salty about it) — after that, it’ll be 1x points per dollar thereafter. My loss is your gain, friend.

If you’re interested and you found this article helpful

One quick note on my referral link below: I’m working with an affiliate program called MileValue. You can learn more about the card below, and follow the prompts to get your own AmEx Platinum. I know the process is a little wonky, and you should feel no pressure to use it, but it’s a nice way for me to receive a small kickback for your application. Love you. Mean it.

Looking for something?

Search all how-to, essays, and podcast episodes.

Explore

While I love diving into investing- and tax law-related data, I am not a financial professional. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, index funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns.

Money with Katie, LLC.

Terms & Conditions | Privacy Policy

This Site Was Built by Brand Good Time