My 6th Credit Card: The American Express Gold Card

Disclosure: This content is not sponsored or endorsed by any of the card brands described here and is accurate as of the posting date, but some of the offers mentioned may have expired. Money with Katie is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com. This compensation may impact how and where links appear on my site, and this site does not include all financial companies or all available financial offers.

All right, I have a confession to make: The primary reason I was drawn to this card is because it’s pink.

I know, I know – beneath all my math and rationale is still a woman on whom corny marketing tactics very much work.

I mean, just look at this baby:

So yeah – maybe I was attracted for the wrong reasons, but rest assured that ultimately, I found my footing.

As a refresher, my current portfolio is as listed:

Discover It card (my first credit card acquired in 2016; I keep it to boost my credit age but don’t use it)

Chase Sapphire Preferred (my first travel rewards card and definitely top recommendation for anyone dipping their toe in the water of travel rewards; it’s at 60,000 points right now and I do most of my spending on this card)

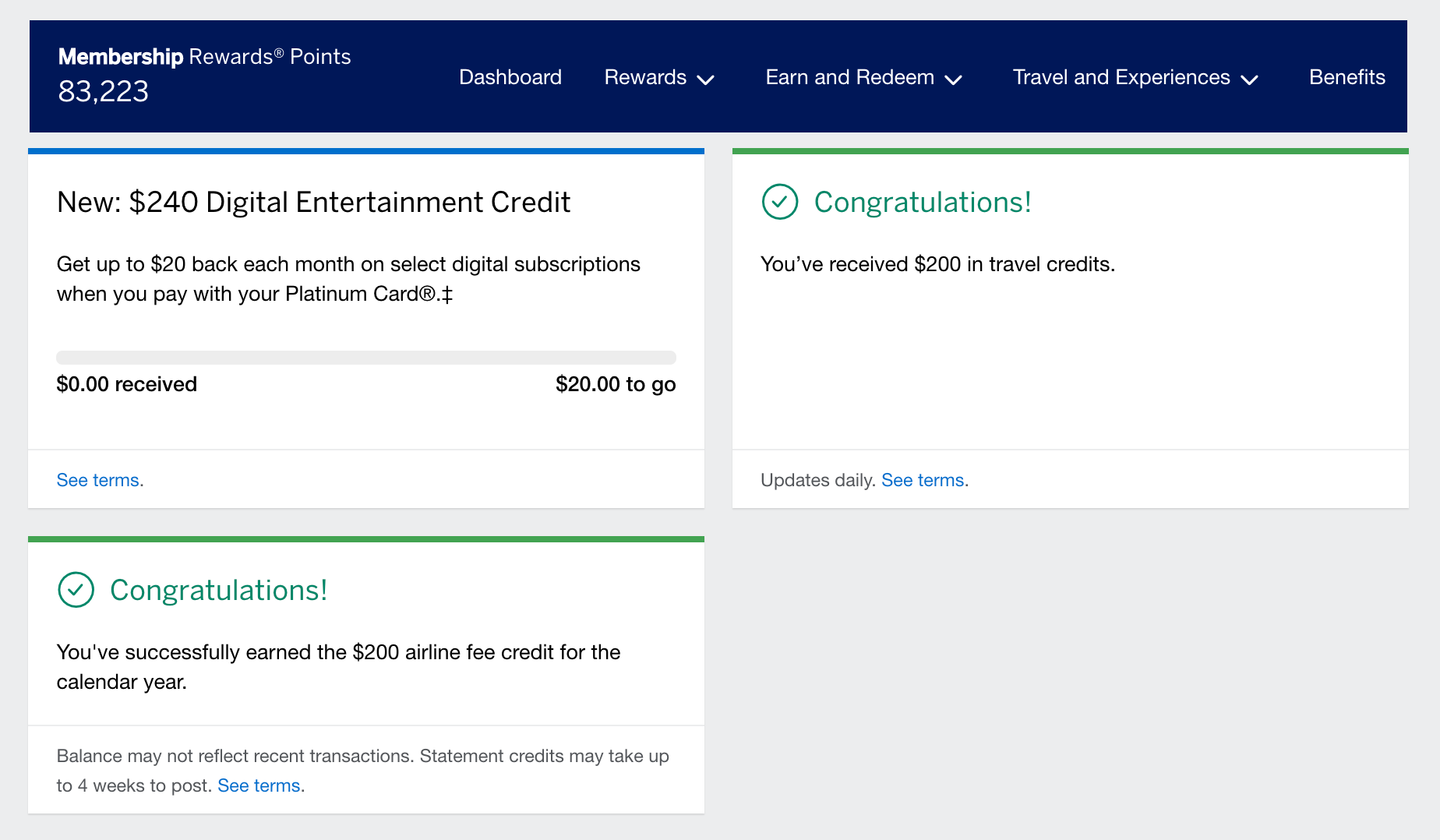

The Platinum Card® from American Express (the high-value, high-annual fee card that gets me loads of perks that I outline here)

Southwest Rapid Rewards Priority (the airline card that I nabbed to both get Companion Pass and ensure I wouldn’t be paying for flights for a while)

Marriott Bonvoy Boundless (the hotel card that enables me to stay for free at Marriott properties)

And as another refresher, right now, I don’t put hardly any spend on the airline or hotel card (#4 and #5) – I primarily use my Sapphire Preferred and Platinum cards, as those are the two with point programs I value most.

Where the American Express Gold card came in

As I looked back at my top spend categories over the course of the year, I realized that there were a few main ones:

Housing (primarily paid for through my checking account, though I can now pay rent via Venmo)

Miscellaneous (read: Amazon) – goes on Sapphire Preferred

Travel (self-explanatory) – goes on Platinum

Food – used to go on whatever card I had handy, usually Preferred

And while my strategy was formerly paying for everything with my Sapphire card to rack up as many Ultimate Rewards points as possible, groceries aren’t a “special” category for Sapphire Preferred – which means I typically earned 1 point per dollar on my grocery spend.

I figured I could do better.

The search for a card that had great food perks

While the Blue Cash Preferred® Card from American Express was the first card I looked at (as it has notoriously good grocery earning potential at a whopping 6% cash back), I noticed the Gold card included restaurants, too, whereas the “food” category for the Blue Cash Preferred Card was specific to supermarkets.

(So at this point, it’s good to know whether or not you (a) would prefer points or cash back, and (b) whether or not you’re also spending at restaurants. The Blue Cash Preferred waives the $95 annual fee for the first year, too, so if you’re a cash back lover who doesn’t travel or dine out much, Blue Cash Preferred may be the move.)

But the allure of the rose gold card was strong, and when I saw the benefits, I decided it was worth it:

4x points on supermarkets and restaurants, including Uber Eats and takeout

Up to $120 Uber Cash (similarly to Platinum, add your Gold Card to your Uber account and each month get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., up to $120 per year – enrollment required)

Up to $100 hotel credit to spend on qualified expenses when you book through American Express Travel

$250 annual fee

Calculating the value of my grocery and restaurant spend

If I buy the groceries and pick up the tab for my family (read: Thomas and me), it’s about $1,000 per month total: $600 on groceries and $400 on restaurants in a busy month.

$1,000 per month x 12 months in a year = $12,000 spent on the two of us, at 4x points per dollar = 48,000 points per year

American Express points are worth about 1 cent per point, which makes 48,000 points worth about $480, depending on how I redeem them.

Add the $120 of Uber Cash and $100 hotel credit (again, only really applicable if you travel) and I calculated the final estimate recurring value to be:

$700

Subtract the annual fee ($250) for net value, and you get $450.

The welcome bonus when I signed up was 60,000 points, so call it another $600 in value in year one.

Making the determination

You can take your grocery and restaurant spend and do the same calculation to figure out how many points your spending would generate to see if it would be worth it. If you haven’t yet nabbed the Sapphire Preferred card yet, I wouldn’t get the Gold card – but if you’re ready to level up a little bit, the Gold card can be a great way to earn more points on a category all humans have to spend in: food.

And hey, did I mention it’s pink?